Kodak, Toys R Us, and Blockbuster were market-leading companies with hundreds of millions of dollars in revenue at their peak. During their heydays, nobody could have predicted that they will one day go bankrupt. Yet, they did and, along with that, became a prime example of why revenue or profit is exactly the wrong metric when it comes to predicting the future of the company.

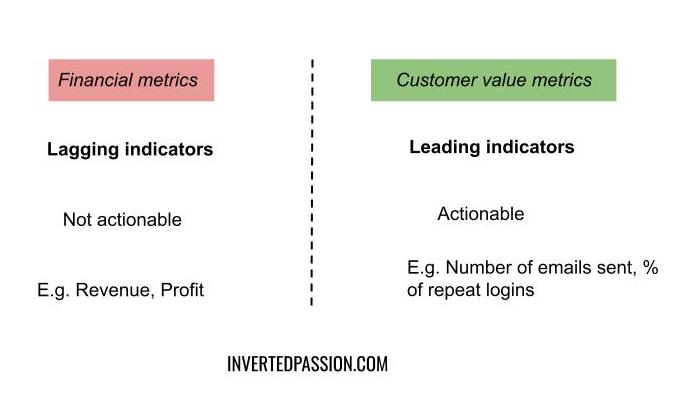

Financial metrics are, of course, important from an accounting point of view. But they are strictly backward-looking. They tell you how the company has performed in the past but have very little actionable information for the future. As an entrepreneur, you need to pay attention to where future growth will come from, not simply review the past growth. That’s the job of the accountants.

So, if not financial metrics, what metrics should you – the entrepreneur – pay attention to?

The short answer is customer value metrics. These are the metrics that track in real-time the value your customers are deriving from your products or services. Essentially, customer value metrics are the numbers that are good proxies for value creation in the world by your product. Another way to look at these metrics is to figure out what numbers are good leading indicators for lagging financial metrics such as revenue or profit.

It’s easy to get customer value metrics wrong. Many startups track user signups or Daily Active Users, not realizing that a customer signing up for the service hasn’t yet derived any value from the product. Good indicators for customer value happen downstream of the signup process, and that’s why they’re also very hard to get right. For example, Facebook used to track how many new signups on their platform end up adding 7 or more friends within the first 10 days.

For VWO, our customer value metric is the total number of A/B tests created on our platform with at least 1000 users. We decided on this metric because if our customers aren’t creating A/B tests, they’re going to churn. Moreover, we excluded A/B tests below 1000 users because those are likely made for debugging or learning purposes.

We validated our customer value metric by segmenting our churn rate by it and, sure enough, customers with higher customer value metrics had lower churn and higher lifetime revenue.

Find your own customer value metrics and then track them obsessively. If you are able to discover metrics that are predictive of your revenue or profits, then you have a magic tool to be able to influence future financial metrics in a very predictable way.

Remember: make customer value metrics your north star, and financial metrics will automatically be taken care of.

This essay is part of my book on mental models for startup founders.

Join 200k followers

Follow @paraschopra