From this post onwards, I’m starting a weekly recap of insightful articles and videos that I come across. This recap serves two purposes: a) curate and filter only the most insightful articles for readers of this blog; b) improve my mental models by reflecting on what I read recently. I intend to do this recap every week, so if you’re interested in reading along with me, subscribe to the mailing list.

The inaugural weekly recap (this one!) is mostly going to be about blockchains and bitcoins. What I find fascinating about the cryptocurrency mania is that perhaps the biggest current phenomenon that’s begging to be analyzed. Previously I covered how fidget spinners became all rage, how Facebook beat Friendster and how Singapore rose into dominance. All those were historical phenomena but bitcoins is what’s happening right now.

If you are, like me, late to the party of bitcoins and blockchains, don’t worry.

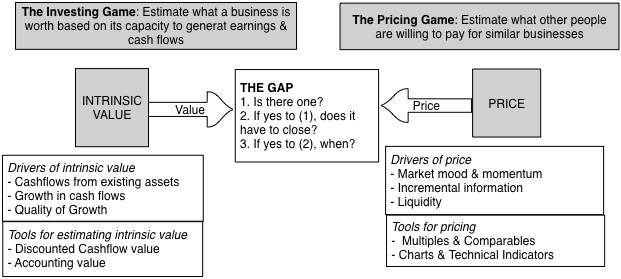

1/ Start with The Bitcoin Boom: Asset, Currency, Commodity or Collectible? Aswath Damodaran, professor of finance at NYU, differentiates between assets (something that generates cash over time in future, e.g. stocks or debt), commodities (something that goes into supply chain as raw material, e.g. copper or energy or wheat), currency (something that is used as a medium of exchange and has no inherent value, say USD) and collectible (something that has aesthetic value for the holder, e.g. baseball cards). He argues that bitcoin is not an asset (it doesn’t generate cash), nor a commodity (it isn’t useful as a raw material), so the big question is whether it’s a currency or a collectible. Nobody knows that yet, so it can be profitable to make your own opinions there.

2/ If you do think bitcoin is more likely to be a currency than a collectible, I recommend reading this analysis on Cryptoasset Valuations. The key idea is that price of one bitcoin is equivalent to the worth of all goods and services traded via it divided by the number of times bitcoins exchanged hands. P = Total-worth-of-transactions-via-bitcoins / Number-of-bitcoin- exchanging-hands. The insight I got was that if people hold on to a currency, it ceases to be a currency. For a currency to be useful, it needs to exchange hands. The concept is called the velocity of money and you can watch a short Youtube video on it.

3/ New York Times magazine had a very long but super interesting article on bitcoins that explains what it is simply, compares its evolution with the early days of the Internet and then explores the potential of the technology behind bitcoin: blockchain. I recommend reading it: Beyond the bitcoin bubble.

4/ Before we move to blockchains, I also recommend thinking about where does the BTC/USD rate come from and what variables impact that rate. Since most of the bitcoin hype is about its price, read about the difference between pricing and valuing and then watch a few videos on how exchange rates are determined.

5/ My understanding of blockchain is that they are a distributed database where data can be appended (but not deleted). No central authority controls that database and yet it has mechanisms to ensure everyone can “trust” that the data in there hasn’t been tampered with. So this means if a blockchain says Alice has 10 bitcoins and Bob has 1, everyone can safely assume that Alice hasn’t “cheated” by falsely updating the database. Traditionally banks do this job by deploying secure databases on their servers, but banks can fail. Blockchain is a technology that guarantees that even if Alice and Bob both delete their databases, this record of who has how many bitcoins will always remain. To start with blockchains, read this excellent introductory guide to blockchains. And then dive deeper via this five-part series titled The Product Manager’s guide to the Blockchain.

If you are in the mood to watch a video, here’s the best introduction on bitcoins and blockchain that I’ve seen so far. (Hat tip to Nilesh Trivedi)

6/ This blog explains many terms of the trade (such as smart contracts, ICOs, etc.) in very gentle terms. A good place to start on that blog is their gentle introduction to blockchain technology.

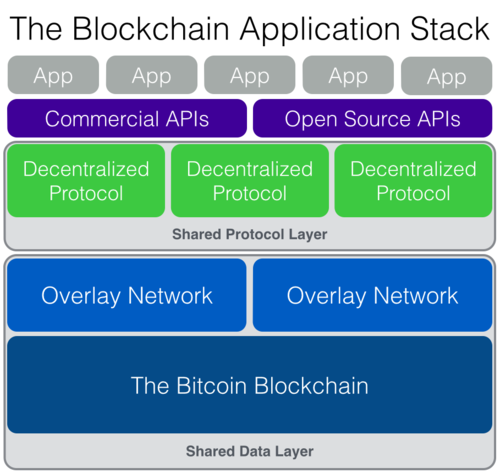

7/ To build better mental models about blockchains, read all of these posts by Joel: The Blockchain Application Stack, The Shared Data Layer of The Blockchain Application Stack, and Bitcoin is like SMTP. If you don’t have time to read these many, make sure you read Fat Protocols.

8/ I also enjoyed Albert’s intuitions about the value of protocols on Crypto Tokens and the Coming Age of Protocol Innovation and foundational innovation of the blockchain.

9/ If you feel ready to dive into building on blockchains, developing on Ethereum is a great start. I found an interactive tutorial where you make a game on blockchain. It’s called Cryptozombies. If you have previous background in JavaScript, you will be able to finish their lessons in a couple of hours. (And, by the way, you’re confused by what does a game-on-blockchain mean, the tutorial will make that very clear). What I found most interesting about cryptozombies is that it is able to interact with a separate game (cryptokitties) without their permission or official API. This interaction is possible because both these apps/games access the same database – the ethereum blockchain.

10/ If you are not in the mood to spend hours learning how to code on Ethereum, you can get an overview via Ethereum for web developers.

11/ For a more detailed and technical dive in blockchains, go through these articles: Life Cycle of an Ethereum Transaction, How to Code Your Own CryptoKitties-Style Game on Ethereum and Lessons learned from making a Chess game for Ethereum.

12/ There’s a fundamental difference between coins like bitcoin and thousands of other new coins you keep hearing about. In fact, anyone can roll out their coins without much technical help. Understand the difference between protocol tokens and app tokens.

One way to understand tokens is that they’re incentive systems for participants. Bitcoins and ethereum coins hold value because they incentivize people to spend money and effort deploying their computers, networks and hard drives to maintain the blockchain. Other coins are incentive systems for other activities such as storage of data, doing calculations or even adopting early.

12/ Before you get excited about blockchain and get deeper into a cycle of confirmation bias, I recommend reading two criticisms. They will expand your perspective and enrich understanding of blockchain’s potential. Read Ten years in, nobody has come up with a use for blockchain and ICOs and Economics of Lemon Markets.

What are your favorite links from last week?

Now that you’ve read the article, I have a question for you.

In last one week, what articles, projects, technologies or videos expanded your worldview and mental models significantly?

Please share your favorite links from last week and I'll RT for others' benefits.

— Paras Chopra (@paraschopra) January 21, 2018

Please share your favorite links from last week (blockchain or non-blockchain, it doesn’t matter!) by replying to the tweet above (+ check out other readers’ favorite links).

Join 200k followers

Follow @paraschopra