There’s typically an information asymmetry between what sellers know about their products and what buyers know. From buyers’ perspective, while engaging in a potential purchase, they never have enough information to know whether what they’re getting is worth the cost (in time, money, effort) that has been asked from them. Even when the seller gives information about the value the buyer will get, buyers suspect because both honest and dishonest sellers say similar things.

So for new products, as buyers can’t tell good products from bad products, they typically end up wanting to pay (in time, money, effort) much less than what the seller demands. In many markets, this drives away good, honest sellers leaving only dishonest sellers (which further aggravates the mistrust). The most famous example of this is used cars market, but some version of this plays in all markets.

One of the major reasons newly launched, obviously good products fail is default mistrust in the market for new tech products. Honest entrepreneurs get penalized in the market because of other dishonest entrepreneurs (who overpromise and underdeliver). So, for success, a key objective for an entrepreneur becomes winning the trust of the customer in the market. (This is why brands and social proof matter).

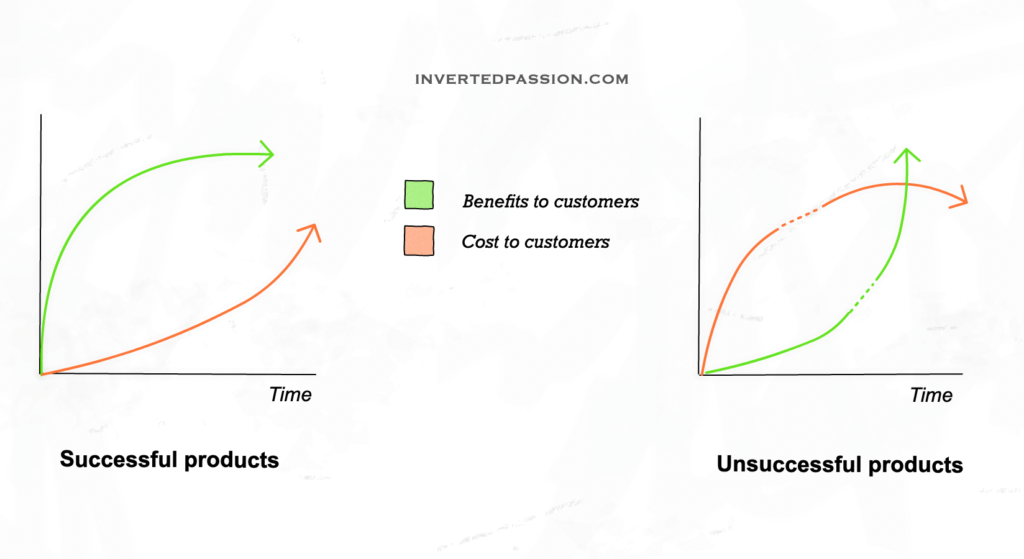

Trust is not binary as customers are continuously updating their beliefs about what products can do for them. Each time a customer is using a product, she is evaluating the costs (what she’ll lose) against benefits (what she’ll gain). Money is one of the many costs. Other costs are time, effort, and reputation investment.

When it comes to costs, it is important to understand that people are loss averse. They’d much rather not lose what they have than gain something new. For example, most people will avoid taking a bet where there is a 50% chance of winning $20,000 but a 50% chance of losing $10,000 even though the expected reward is positive (0.5*20k – 0.5*10k). But almost everyone will probably take a bet where there is a 50% chance of winning a million dollars and a 50% chance of losing $1000. This shows that in order to make a decision, people expect benefits to be much more than costs.

During repeated interactions with the seller (starting right with the initial pitch to the experience of the product), people are continuously estimating their benefits. At any moment, when their estimate of costs (that they know for sure – fill a form, talk to sales, $299/mo cost) seems to be higher than the evidence of current and future value, they drop off from the interactions with a brand and abandon their journey. Good salespeople understand this dynamic and start the conversations that put people at ease and only at the very end ask something tangible from them (like a request for another meeting or a trial implementation).

Your interactions with customers should be a dialogue (and not a monologue) where you’re delivering more value to them than what you’re asking for. If you make a big ask from them before they’ve gotten enough value from you, they’ll drop off. If you deliver value first and then ask for something later, they’ll oblige.

Popular examples of brands that do it right are freemium products such as Dropbox that let people get benefits first and only ask for money later. For many consumer products like an iPhone, before people purchase, they have already gotten psychic benefits from imagining how their life will change with that new shiny phone. And that is what good marketing does for a product – convince customers of the benefits before asking for an investment from them.

Remember: marketing at all times has to deliver more (actual or anticipated) benefits to the customers than the investments it requires them to make.

This essay is part of my book on mental models for startup founders.

Join 200k followers

Follow @paraschopra