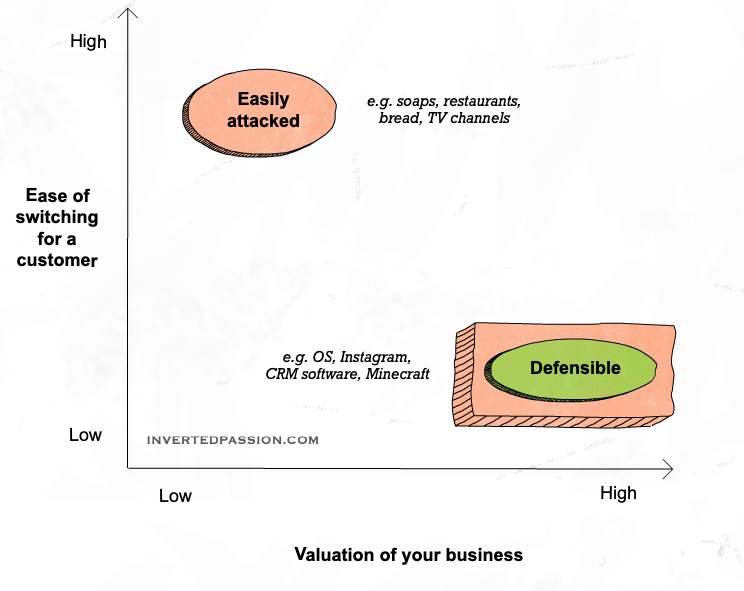

Switching costs determine how valuable your business is because investors value a business equal to its expected future profits. If your customers are able to switch easily to a competitor, potential investors see that as a risk, and hence will not value the business highly as potential future earnings of a business can easily be taken away by a competitor.

If building a business is hard, building a defensible business is harder and that’s why they’re rare. Warren Buffet’s top criteria for evaluating a business is the presence of moats. In old times, castles were protected by trenches filled with water which were known as moats. Such moats protected against an enemy attack as they were not easy to cross. In business, moats are whatever deters a potential competitor from taking away your customers.

Buffet explains the importance of business moats quite clearly in one of his letters:

“A truly great business must have an enduring ‘moat’ that protects excellent returns on invested capital. The dynamics of capitalism guarantee that competitors will repeatedly assault any business ‘castle’ that is earning high returns.”

Moats could be patents, trade secrets, or exclusive partnerships that give you access to something unique that your competitors don’t have.

Perhaps the most important moat is the switching costs that your customers incur when they move from your offerings to your competitors. If it’s trivial for a customer to switch, you do not have a defensible business. To increase switching costs, get your customer to invest in your offerings. Such investment could be of various types:

- Historical data storage: customers won’t switch to competitors if they’ve stored their historical data that cannot be exported easily. Typical examples: email, CRM, or Facebook.

- Habits and familiarity: for products that are used at a high frequency (such as personal phones or browsers or Coca Cola), the development of habits with such products pose a big deterrent for switching because people will have to build new habits and relearn what’s now familiar to them.

- Sunk cost: if customers have already paid for long-term use of a product, they’re unlikely to switch to a competitor mid-way and waste their investment. This is why SaaS companies prefer charging annually. But perhaps, the classic example of this is the Gillette razor which only works with Gillette blades.

- Customized solutions: an offering that’s unique each customer also has a high switching cost because it’s unlikely that the customer will get the same unique customization from a competitor as well. A typical example of this is operating systems such as Windows, Linux or Mac which allow a user to assemble programs or apps that are uniquely suited to his/her needs. It’s unlikely that the user will get the exact same combination of programs in another OS. Even if there are a couple of programs that are only available on Windows that a customer uses, s/he is unlikely to switch to a Mac.

Highly valued businesses have several of these switching costs built into their products. The best example of such combined switching costs is Apple’s iPhone. The unique combination of apps on its app store, storage of data and photos on iCloud, and the muscle memory of its design ensure that iPhone users continue on the iPhone. And this defensibility of the iPhone’s business is markets value Apple so highly.

Remember: successful businesses attract competitors. Build moats from day 1 of your business to protect against their attacks.

This essay is part of my book on mental models for startup founders.

Join 200k followers

Follow @paraschopra