I’ve recently relooked at my personal portfolio and realized I have a thing or two to say about investments. So here it goes:

1/ For goodness’s sake, do NOT keep your money lying in a savings account or do a fixed deposit (FD).

We generally inherit this financial laziness from parents. You can do better than them, no?

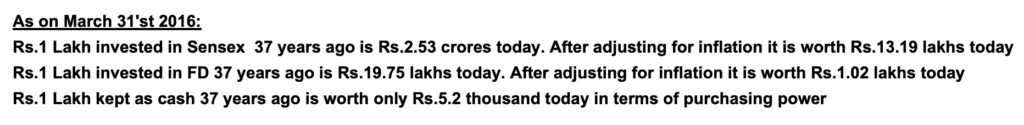

2/ Realise that you are actively *burning* money in FDs / savings account.

If you incorporate inflation and tax on interest income, your corpus is likely getting smaller every passing day.

3/ What if I told you that a couple of hours invested in pushing some buttons online can give you 13x the returns that you get from FDs?

Yes, do the math of compounding for FDs vs long term market returns and you’ll know.

4/ Compounding is REALLY hard to get your head around.

If you expect to live long, there’s no reason why you should stick with your money in FDs or bank savings account.

5/ There’s a legitimate scare of short term risk involved in equities. The key word here is ‘short term’. Unless you have a specific expense coming in up in 1 year, all your perception of risk about equities is unfounded.

6/ This is because equities don’t lose money until you sell. And if you don’t require money for an expense, you can keep invested almost forever.

7/ To understand equities, know what you are investing into.

When you buy equities, you are investing into collective human ingenuity that’s called commerce.

8/ When you own a stock, you own rights to future cash flows in a business.

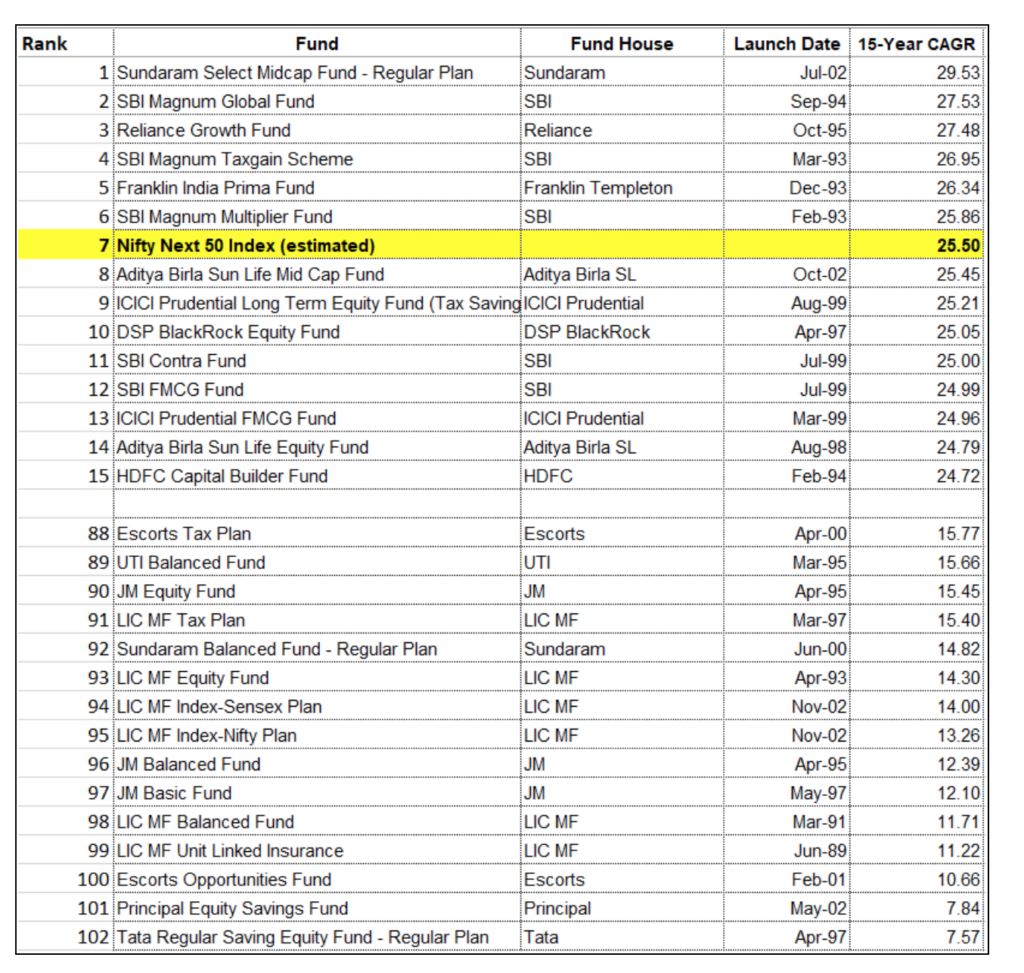

Unless you imagine the world’s commerce coming to a halt, equities over long term will always give returns as businesses will always keep generating cash.

9/ This is also why equities beat inflation over the long term. When inflation rises, businesses simply charge more and hence their income increase and so does equity returns.

10/ When you invest in a FD (or a bond) with a fixed interest rate, you are trusting the judgment of government officials (that are few in number) on what future looks like.

11/ When you buy an index fund that tracks the entire stock market, you are trusting the judgement of millions of consumers and the magic of the market in allocating right resources to right needs.

12/ So buying equities seems like the right option, but unless you have time, bandwidth and knowledge to study companies deeply, avoid purchase direct stocks. There are too many things that can go wrong with an individual stock.

Buy a mutual fund instead that holds multiple stocks in the portfolio.

13/ But mutual funds come in two flavors: actively managed by a fund manager or passively managed that simply and blindly tracks a collection of stocks in an index like Sensex or Nifty-50 (which consist of diversified 50-100 companies).

So if you own a passive fund, you are automatically diversified.

14/ Historically, the passively managed mutual funds have outperformed most of the actively managed mutual funds.

This is because the judgment of a single fund manager (unsurprisingly) turns out to be poorer than the collective judgment of millions of investors who buy and sell stocks directly.

15/ Because there’s no fund managers, these passive funds are cheap. They charge significantly less than other mutual funds because there is no fund manager. You are trusting the collective judgment of all stock market.

If you are in India, passivefunds.in seems like a good website listing all known passive funds.

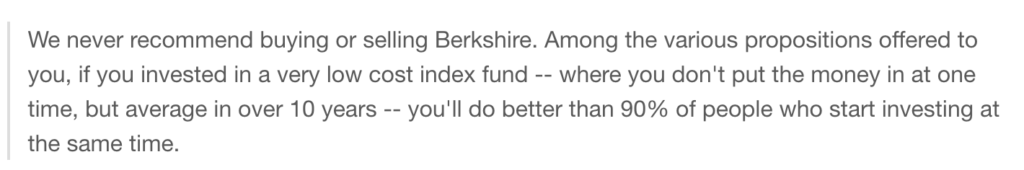

15/ If you don’t trust my advice about passive funds, take it from Warren Buffet:

16/ I hope you found the advice useful.

You don’t need to be a wizard to invest.

If investing is not your full-time job, simply trust the judgement of collective human wisdom and invest in a passive fund that tracks the collective stock market.

Join 200k followers

Follow @paraschopra