The financial purpose of a business is to generate over its lifetime a higher return for its shareholders than what they would have gotten by investing in risk-free options (such as government bonds).

Imagine there is an entrepreneur with a business proposal and she requires $100 as the initial investment. She reaches out to you and pitches her idea to seek your investment. To make a decision, you’ll probably analyze and estimate how much return you’d get in return for the money you give to her. If you usually get 6% interest annually in a savings bank account (which happens in India), you would expect a higher return than that from the entrepreneur (especially since there’s a risk of losing your entire $100 while your money in the bank is virtually risk-free).

The entrepreneur succeeds if she’s able to deliver you a much higher return than you would have gotten from relatively “risk-free” investments such as government bonds.

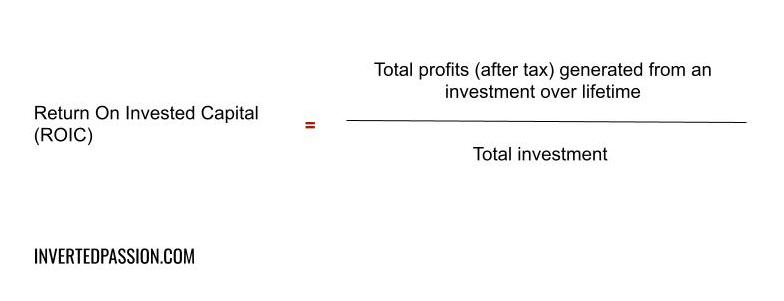

Because ROIC is how investors track the performance of their investment, it automatically becomes the most important metric through which entrepreneurs and companies are judged. Higher ROIC directly translates into more attractiveness of a business and hence garners higher multiples for valuation.

Warren Buffet is one of the most successful investors of all time and this is what he said in his 1992 Berkshire Hathaway Shareholder Letter:

The best business to own is one that over an extended period can employ large amounts of incremental capital at very high rates of return.

ROIC is not just important for investors but is also a fantastic decision criterion for entrepreneurs when they’re deciding which area or project to invest in. It’s a no-brainer to invest in projects where lifetime returns from the investment are expected to be much higher than what you’d get in “risk-free” investments (also called cost of capital).

ROIC also explains why companies that give out dividends to their shareholders are generally valued less than companies that retain the earnings or don’t generate earnings at all. In the former case, shareholders deduce that the company has run out of investment opportunities that could provide a return higher than risk-free return. And if a business can’t compound money at a faster rate than a bank, investors would rather put their money elsewhere.

An important caveat in calculating ROIC is lifetime returns (discounted by an appropriate discount factor) and not just immediate returns. That is what drives many tech companies to invest aggressively in user acquisition because they know that the lifetime revenue from acquired users over the years will justify high upfront acquisition costs.

Remember: a business is valued highly if it’s expected to regularly generate returns much higher than the “risk-free” returns that investors get in a savings bank account.

This essay is part of my book on mental models for startup founders.

Join 200k followers

Follow @paraschopra