I had tweeted about my willingness to give thoughts and feedback on a startup’s deck. Anup from Spext reached out to me with their deck. I’m deconstructing it below and after that, I’ll answer questions that Spext specifically wanted me to focus on. Note that my understanding of the market is limited to a few hours I spent doing the analysis. This deck is published with Anup’s permission.

The offer for analyzing decks still holds, in case you are interested, email me your deck.

The deck and my analysis

I don’t like the description “Google Docs for Voice Data”. The reason for it is that people use Google Docs for multiple use cases. Some use it as an alternative to Microsoft Word, some use it for collaboration and some use it for making quick notes. So “Google Docs for Voice Data” doesn’t tell what exactly is Spext. Their homepage has a clearer description: Automatically transcribe hours of interviews, podcasts or videos in minutes.

The description isn’t just a matter of words. Words we use end up shaping our actions. In this case,

how an entrepreneur describes his/her products ends up becoming the future focus. We called VWO the world’s easiest A/B testing tool and this made us prioritize usability over features. Had we called VWO the world’s fastest or most powerful tool, our product would have taken a very different direction.

I think Spext needs to carefully think about the phrase “Automatically transcribe hours of interviews”. Do customers care whether the transcription is automatic or manual? My guess is that, as long as they get a transcription, they don’t care how it’s done. A perfect radio is no radio, just pure sound. However, customers do care about price, speed, accuracy and other attributes that matter to them. Taking a wild guess about their market, waiting for one day to one week to get transcriptions done is painful, so how about focusing on speed. Something like: “Finished recording podcast or making a video? Get its transcription in less than a minute”.

I like this. Too many entrepreneurs get into the details of the product right away. But this deck makes sure that the reader understands why should she pay attention. It’s easy to forget that a presentation isn’t about the presenter, it’s for the audience.

An improvement on this slide would be to show an attention-grabbing number that makes this “exponential change” concrete. Perhaps, mention that “300 hours of video is uploaded on Youtube every minute“, or that “one in five people listen to podcasts regularly, up from one in ten a couple of years ago” or that “more than 5000 new podcasts are launched on iTunes every month. And most of them need transcriptions”.

I’ll make this slide concrete too. Mention how much an average transcription costs, and how much an average podcast/video earns. If it costs more to transcribe than an average podcast earns, it gives an immediate understanding of a gap that tech can fill.

Nope, this slide doesn’t talk to me. A screenshot of an app doesn’t tell me if it’s hard or easy. All I see is waveforms. What could have helped me to understand the difficulty of transcription is a statistic like “one hour of video can take 4-9 hours to transcribe” or a quote from someone who enrolled in a course to learn this app (and how many hours did it take for them learn).

No. This doesn’t convey anything new. Every slide is important, and my advice is not to waste them to reiterate points that have been made already.

Again, data could help here. What’s the ratio of transcribed vs non-transcribed audio on the Internet? How many bits of information does that represent vs the written and indexed information on the web? Use data to show the opportunity’s scope.

Also, what happens if the gap isn’t addressed? What’s the growth rate of the gap and how much bits of information will humanity miss on because it’s non-indexed or non-searchable?

I think the information presented here is crisp but the order of presenting it could be different. I like the approach mentioned in this article (and I LOVE it). Andy Raskin (the author of the article) calls the solution that a startup proposes “a promised land” to an undeniable change in the world. So, perhaps this slide could be about the promised land. For example, something along the lines of: “In future, audio will be treated like text: editable, indexed, searchable and hyper-linkable”. And then introduce Spext as the platform to enable that future. (Also show evidence of increasing accuracy of voice recognition as a proof of that promised land.)

Next few slides that describe Spext’s solution could be positioned as features that will help the customer get to the promised land.

On this slide, I’d contrast “audio without Spext (not searchable)” and “audio with Spext (searchable)” to clearly indicate that promised land can be had with Spext (and not without it). Also the illustration used on the slide doesn’t convey the importance of searching. Perhaps they could show a screenshot of an arcane query like “what color is the turtle’s tongue” and show text results as “No results found” and audio results finding lots of results (from lectures, podcasts, videos). This reinforces the idea that there’s lots of information locked in the audio that Spext could unlock.

Again, I’ll contrast “editing without Spext” (re-recording the entire podcast) and “editing with Spext” (cut the unnecessary text and the audio cut happens automatically).

I’m not sure if this slide is required. It doesn’t have the same impact as previous two. Perhaps they can replace this slide with the summary of all other features that their product has (and benefits of those features for the customer).

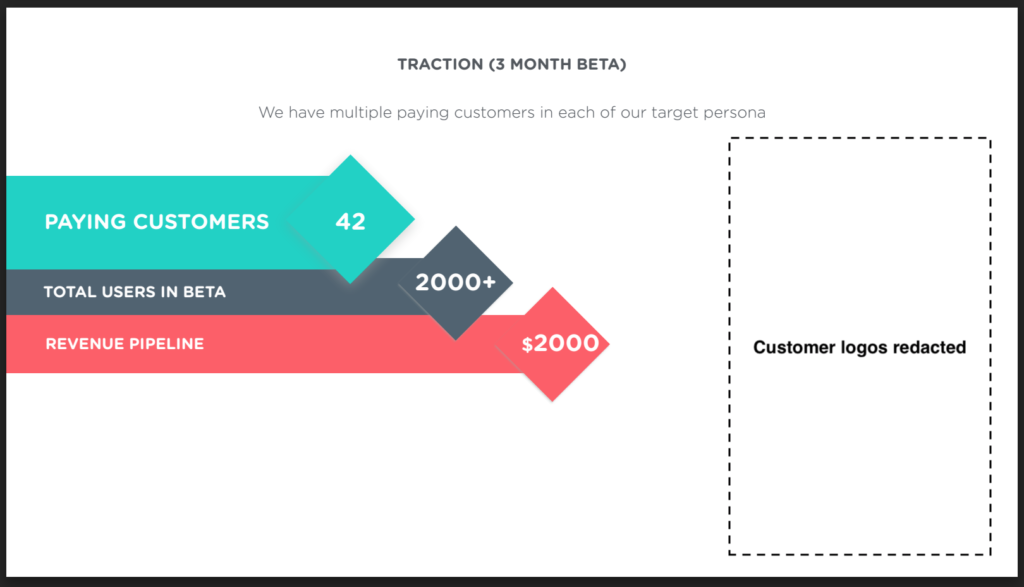

Things I like on the slide: the missing MRR (I’m guessing it’s too low to be mentioned), number of paying customers, customer logos. What I don’t like on this slide: Revenue pipeline ($2000; too low to be interesting), a graph that isn’t there (even if it’s 3 months, show a graph that looks like it’s increasing – number of hours transcribed, number of users, etc.). People love things that seem like growing.

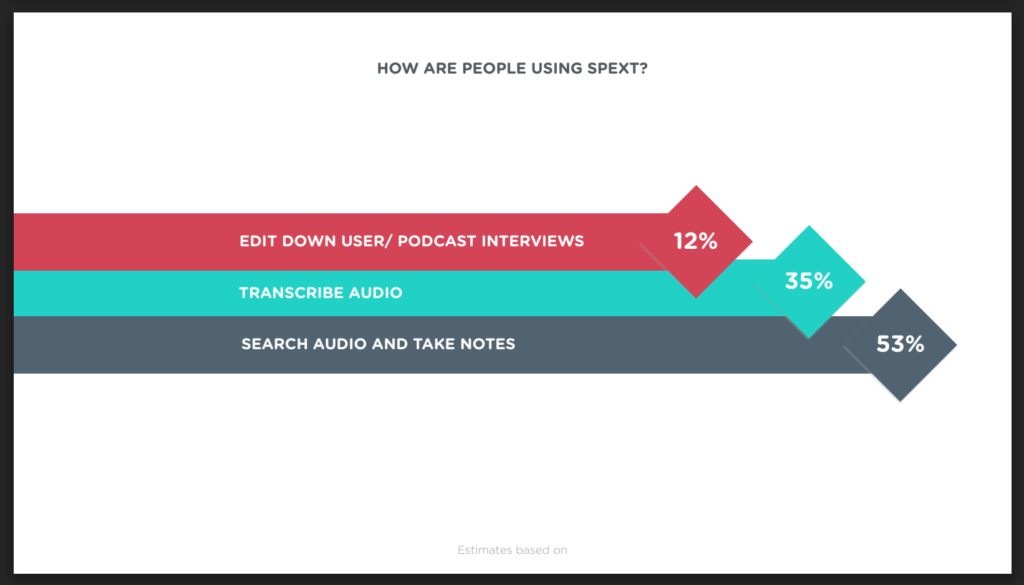

This isn’t a very useful slide as I’m not sure what to do with this information. Rather, concrete examples of use cases could have been more useful. The customer logos in the previous slide could be reiterated here with their respective reasons for using Spext. For example, taking wild guesses here, “Univ of X” transcribes class lectures, “Customer Y” transcribes podcasts. All these use cases spark ideas in investors’ minds about potential market.

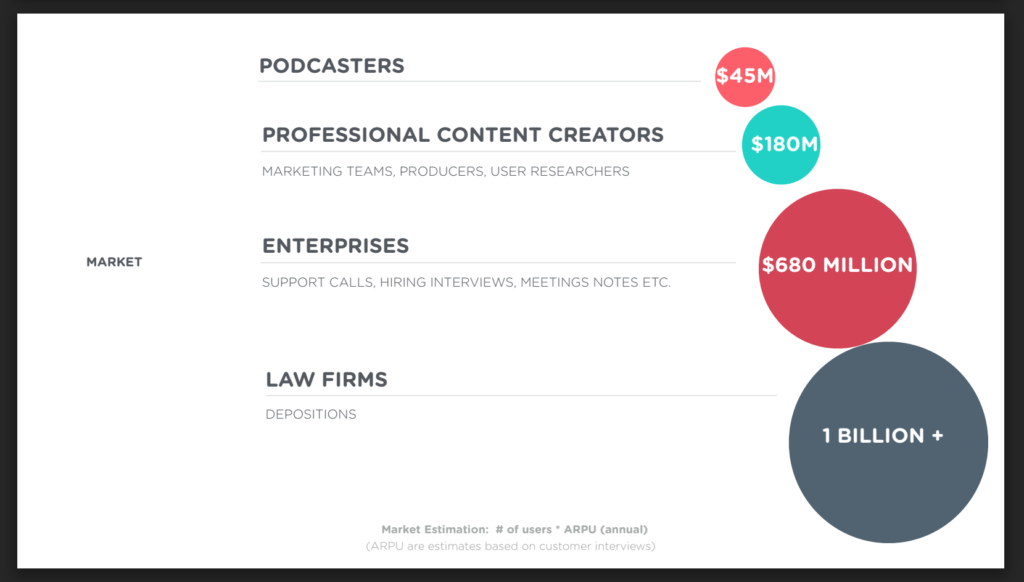

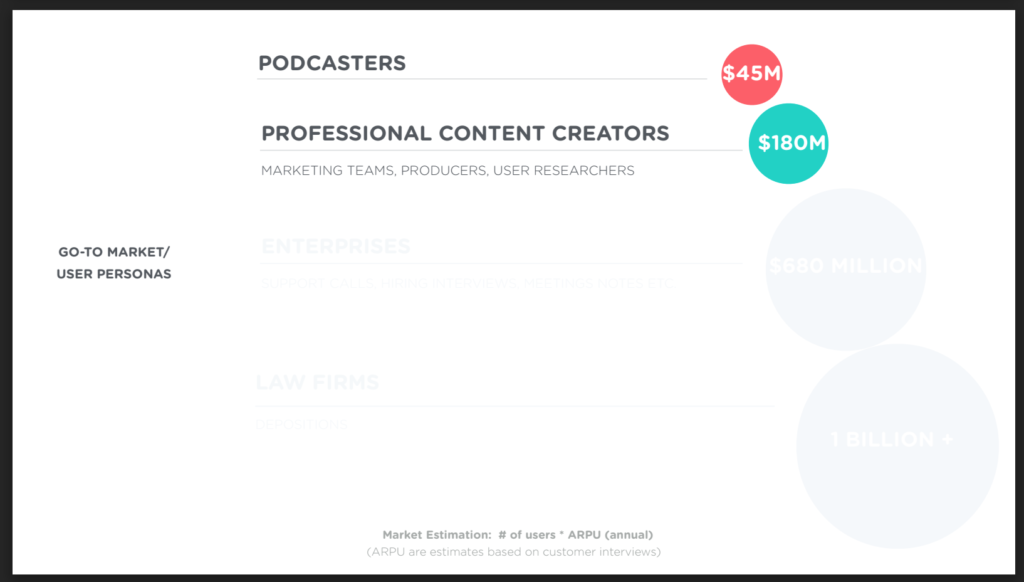

Not very useful at this point in the deck. So far in the deck, the audience has an intuitive feel for the market but they still don’t have evidence on how (and why) Spext is going to grow. The bottom-up approach to market sizing would give a more confident view of Spext’s future than these pie-in-the-sky estimates.

Bottom-up market estimation is hard, but not only it’s important for the deck, it’s important for startup’s own clarity. Spext needs to know where their revenue is likely to come from. They need to know how many customers do they require to hit $1M ARR and given their trajectory, in what time frame is this likely to happen (if at all). Of course, all these are future guesses, but without guesses, there will be nothing to validate or invalidate. These guesses will also highlight loopholes in their model and any unsaid assumptions that may not hold true upon closer scrutiny.

Not really sure about this slide. My guess is that this slide shows who they’re targeting now. If so, that needs to be clear along with the reasons why they’ve chosen this market and not the other one (say law firms).

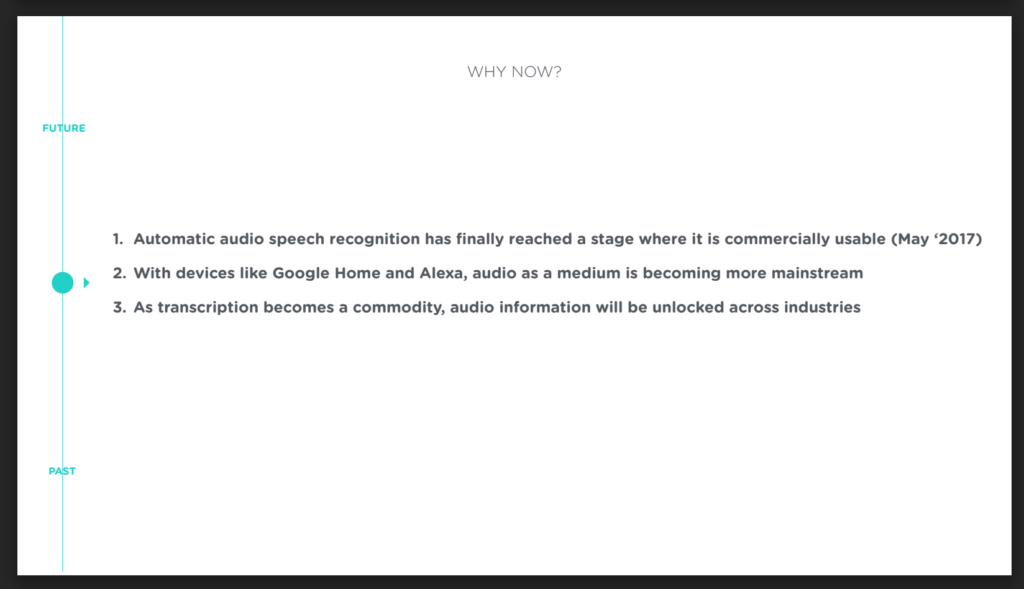

I like this slide but it should have been positioned earlier in the deck (along with the “promised land”). Perhaps, something along the lines of “The arrival of editable and searchable audio is nearer than you think. Here’s why”.

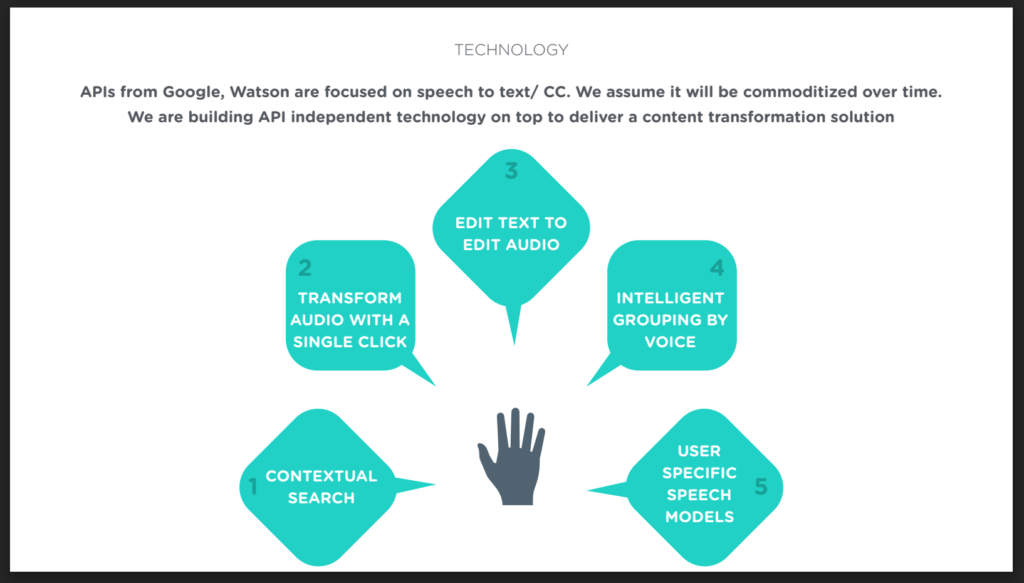

I did not understand this slide. Are they using Google or Watson’s API or not? What does “API independent technology” mean? What is their secret sauce? They obviously don’t have to reveal it, but it needs to be clear that it’s there. For example, the secret sauce for Google was PageRank and for Facebook, it was their exclusivity. Answering what’s their secret sauce will also help them in thinking about the defensibility of their business.

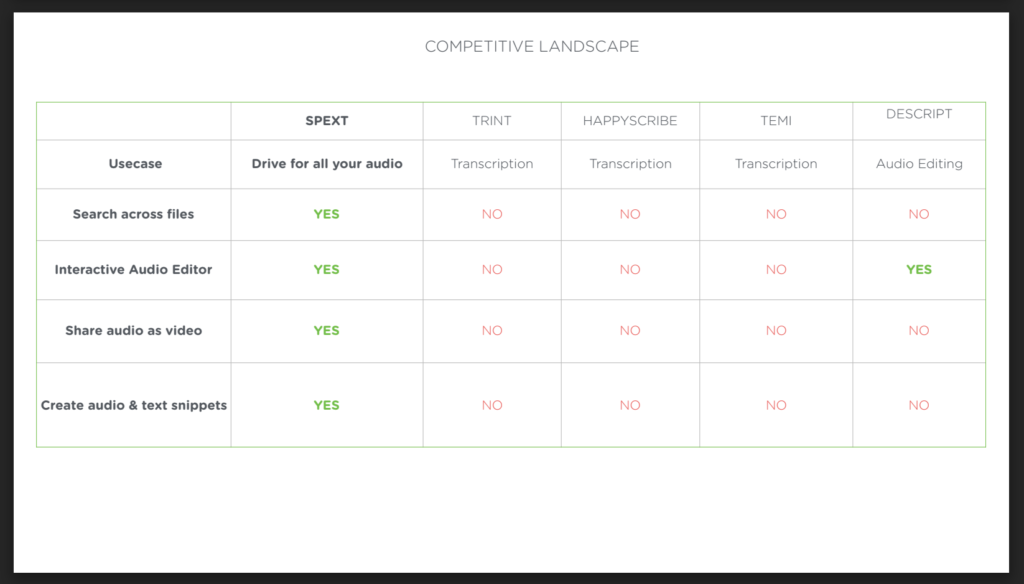

It’s good that they’ve included this slide but it leaves many things unexplained. The objective of presenting competitors on a slide should not be “I have more features than them”, it should rather be a comparison of focus and sources of unfair advantages. Rather than saying “heres-how-we’re-beating-competition”, say “heres-why-we’re-beating-competition”. Are competitors focusing on law firms and Spext on podcasters? Say it. Are your competitors focused on the enterprise market, but Spext is focused on the mid-market? Say it. Do you have PhDs in speech recognition on your team? Say it. Exclusive tie-ups or contracts? Say it. Mention your unfair advantages over the competition.

If you’re able to contrast your startups’ unfair advantages or focus against established competitors, you can even use their revenue or valuation to paint a bright future of your startup. How impressive will it be when you mention a higher accuracy rate than your $100m

ARR competitor and that the competitor cannot match your accuracy because your’s patented? If you are able to make a statement like that, it shows that you understand what you’re doing.

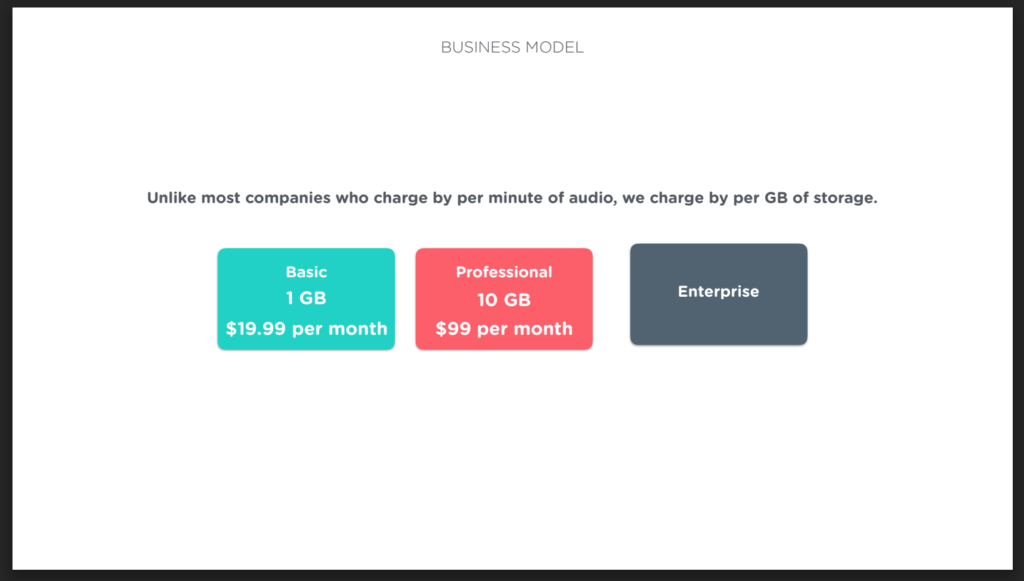

Again, don’t just mention how you’re different but why that difference matters (in your favor). Looking at this slide, I have no idea whether charging per GB is wise or foolish.

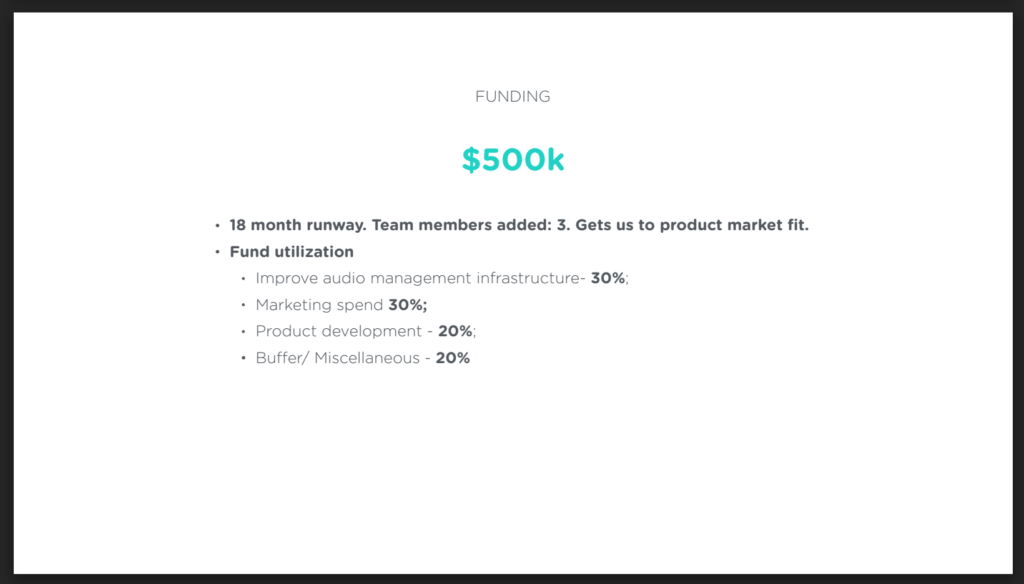

Not sure if details on how funding will be used is required. Instead, what’s required (but missing) is things like cap-table, the percentage of funds committed and whether they have a lead investor or not. Also, the phrase “(we require funding to) get us to product-market fit” isn’t very encouraging. Investors are unlikely to shell out $500k for a company that’s pre market-product fit.

Questions by Spext

I asked Anup if he had specific questions for me to comment on.

1. If we are to bootstrap this business, how would we think about it?

Move in with your parents. Seriously. There are only two ways to bootstrap: increase revenue or reduce costs (and you only have control over one of them). My recommendation would be to reduce personal costs to a minimum and then to increase revenue, play with pricing.

Pricing is all about positioning and it’s one of the biggest levers for increasing revenue. By showing the recommended price as $23.99/mo, they’re driving away customers who can pay them $239/mo or $2340/mo. It could be useful for Spext to experiment with removing existing packages, have a catch-all pricing (like they have now: $0.25/minute) and keep a “contact us” for monthly packages. With 40+ customers, they need to explore a much wider range of pricing than the $14-$23 range. At $20/mo, they’d require 4100+ paying customers to hit $1M ARR. Not many companies have been able to build big businesses targeting such a lower price point, so they need to choose their future market carefully.

2. We have users in 2-3 usecases with only minor changes in workflow (like 80% of the flow is common). How should we figure out growth?

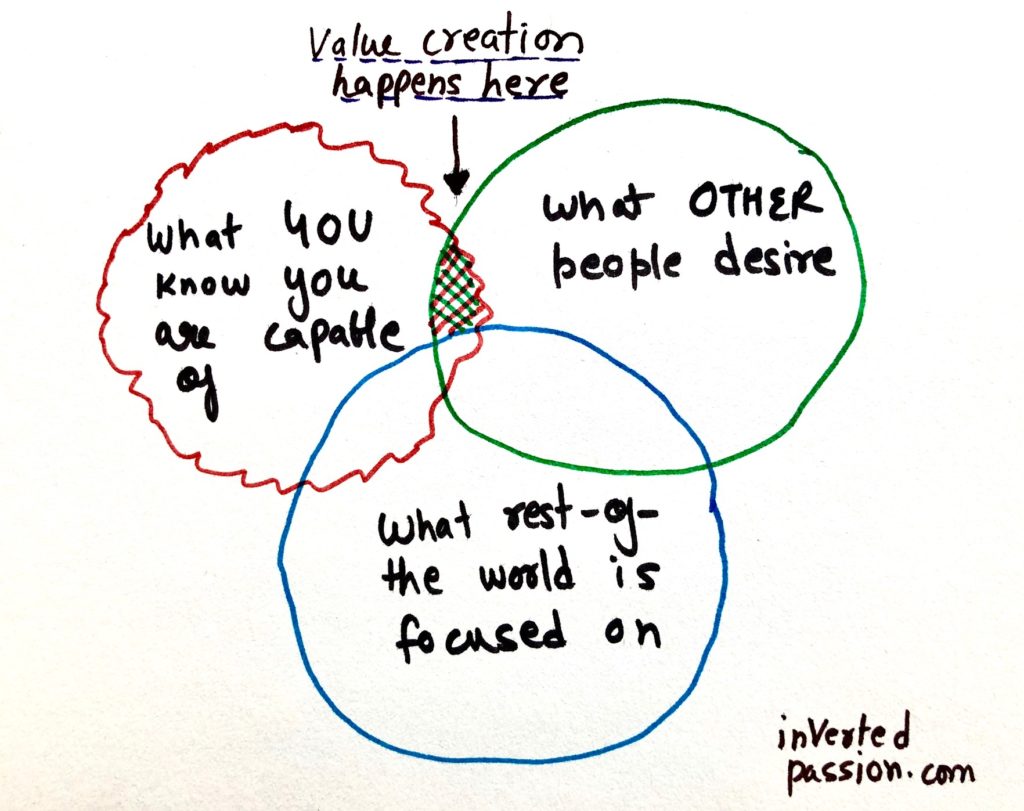

Use the Inverted Passion model (below) to think about where growth will come from.

To apply this model, ask following questions:

- What are your best customers using your product for? By best, I mean those who pay the most or use it most often or a mix of both. Find who these best customers are, where they hang out (offline or online) and target them with messages addressing their pain points. If there are 5 paying customers for a use case, there’s 50 more like that somewhere out there.

- Who are your competitors focused on? Where are they likely to focus in near future? Do you have a use case that’s hard for them to copy (for any reason, including changing their focus or product direction)? Do something valuable for customers that’s hard to do for competitors.

- For which use cases, people are already paying to someone else? It’s extremely hard to get someone to start paying, but it’s easier to get a customer divert money from one place to another. Podcasters who have never paid for transcription are unlikely to pay, enterprise that have a transcription budget have to use that budget. Attack the low hanging revenue first, don’t go on a crusade to convert non-customers into customers.

3. What can be done to develop short/ long term moats?

I’m glad you asked this question. I was suffering from startup complacency in early years of Wingify and did not appreciate the importance of moats.

Moats are aspects of your business or product that make it hard for competitors to snatch your customers. Because of competition, profits have a tendency to dissolve to zero. So an entrepreneur needs to think from day 1 on how s/he will prevent someone else coming along, replicating the functionality, lowering the prices and eating away his/her lunch.

Moats require an entire post, but take here are a few pointers:

- The more investment (of time, money, reputation) a user does in a product, harder it is for him / her to switch. In Spext’s case, this means building features that makes user store more and more of custom data (like edit history, search keyword history, notes on audio, etc.) on its platforms.

- Use the endowment effect by continuously updating statistics on usage of the product. For example, weekly reports on the number of words indexed on user’s audio, number of unique phrases, MBs processed in the user account. Show numbers relevant to the user that increases with time. They’d not want to lose it later.

- Involve more people from the organization to interact with Spext. More the number of people dependent on a product in an organization, the harder it is to take it away. This is why in a family, both Netflix and Cable will are usually paid for. So, think of features that a wider audience in an organization can interact with? If it’s podcasters, can you make a widget for displaying transcriptions? Think about which all directions will the pressure to maintain status-quo come from when the issue of changing from Spext to competition is raised

- Get integrated into their systems and make using Spext into a habit. The tools and systems that customers use for recording should automatically trigger usage of Spext. Once this chaining happens, it’ll be hard for them to break the workflow and their habits for a competitor.

- Think of personalization and network effects. Is there anything in Spext’s products that increases benefit for the user as the user spends more time with the product? Perhaps a customized voice model per customer. This way, competitors will start from group zero once they acquire a customer and your lead with the customer will increase over time.

4. How should we think about pricing?

Read this article: Why you shouldn’t set prices based on value created

Closing thoughts

I think two main topics are missing from the deck:

- Accuracy: What’s the accuracy of the service? How does it compare with humans?

- Google’s role: Google is big on automated transcriptions for Youtube videos (and it’s getting better over time). What’s the role of Spext in a world where Google indexes all audio and video and makes it searchable for free?

I hope my analysis was useful to Spext and other entrepreneurs reading this article. If you want me to analyze your deck, email me and if I agree, I’ll do it on Inverted Passion.

Join 200k followers

Follow @paraschopra