I’ve written earlier that startups shouldn’t solve technically challenging problems. I still maintain the same view but wanted to add an important caveat to that claim.

The caveat is that startups shouldn’t exclusively rely on a specific technical innovation as their main advantage. I’m talking about narrow technical innovations such as making a better internal combustion engine, cheaper glue, and so on. Startups generally protect such specific innovations via patents but they’re not sufficient protection and hence quite weak as moats.

To see that, it’s important to understand what patents are for, how they’re granted, and how they’re enforced.

What are patents?

Patents are exclusive rights to an invention given to the inventor. A patent must be: a) new (without any prior art); b) non-obvious; c) sufficiently detailed so that a skilled person can replicate the invention. Once granted, a patent (in most countries) prevents anyone else to sell for 20 years whatever is described in the patent. A patent consists of one or more claims. It is these claims that ultimately the inventor seeks to preserve as their exclusive property (till the time patent is valid.)

In theory, this seems an obvious protection/moat for a deeptech startup. But there are a couple of issues that work against a startup when it comes to getting protection from a patent:

1. A patent does not mean the invention is commercially useful

This is an obvious point, but worth emphasizing. A patent is granted for an invention, but it doesn’t imply that the invention is of any commercial worth. In fact, it’s estimated that the majority of patents are worth less than their patent filing fee.

2. Strong patent applications require a large investment into legal fees

The strength of a patent lies in how long is its claims section and how well are the claims supported in the application. Such strong patents cost money and they can patents can cost up to $20,000 a pop. A big company can afford it, but a scrappy probably startup can’t and hence startups often go for simple patent applications which contain fewer claims.

But fewer claims mean a potential competitor can simply work around the patent by making simple modifications.

3. The onus of enforcing patent lies with the patent owner

Once a patent is granted, the responsibility of keeping a watch for patent infringement lies with the patent owner. This means that if a startup ends up creating something commercially useful (thereby resolving a key uncertainty), competitors often show up to replicate it and eat away the profit.

When a big company knowingly or unknowingly infringes upon a startup’s patent, the startup can’t easily defend itself. Patent battles go on for years and cost millions of dollars. Even though patent trial funding and insurances exist, startups are still disadvantaged as compared to better-funded rival big companies who can afford the best IP lawyers out there.

So what moats exist for a deeptech startup?

A patent by itself isn’t strong protection. In general, deeptech companies have weaker moats compared to consumer/software companies. This is because, for the latter, network effects make up a strong moat.

But it’s possible for a deep-tech company to build a business moat in other ways. Combining all of the moats is even better than pursuing a single moat.

1. Huge funding to be able to file strong patents and defend them

A patent in itself isn’t worth much. But patent plus funding is a strong deterrent.

So to build a moat using patents, a startup has to be sufficiently funded to file strong patents and then have enough money to litigate those who infringe its patents.

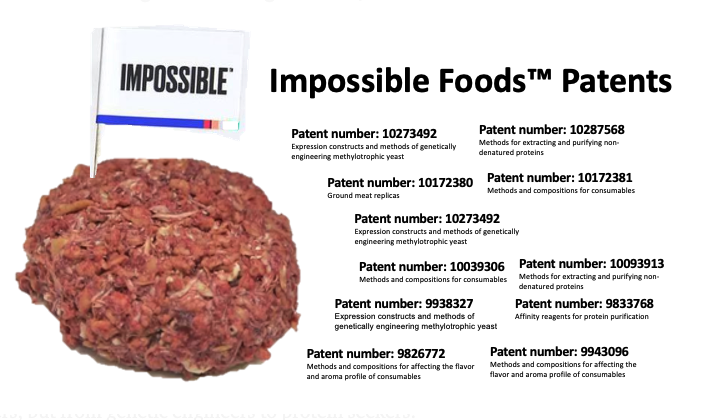

The plant-based meat company Impossible Foods provides a good case study of this. They’ve been developing a plant-based burger that tastes like beef. Over time, they’ve developed a thicket of patents around their burger.

Just recently, they filed an infringement case against a competitor Motif Foodworks. This shows two things:

- It’s easy to replicate technology invented by an innovator (Motif quickly followed in the footsteps of Impossible)

- The innovator has to be well funded to defend its patents (Impossible has raised $2bn so far)

2. Traditional moats: brand, distribution, exclusive contracts, etc.

Of course, nothing prevents a deeptech company to have non-technical moats such as brands, distribution networks, or exclusive contracts with suppliers.

SpaceX is a great example of this. One of the moats they have is the exclusive long-term contracts from NASA that won’t be given to other competitors. This is mostly because, in launching satellites, the history of rockets matters, and building a history of safety is a strong moat in itself. This video goes into more detail about the different kinds of moats that exist for SpaceX.

This moat is due to the regulatory requirement that prevents competitors. The same type of moat exists for pharma where FDA gives exclusive right to market a drug for five years after approval. And, I think a similar moat exists for startups working on nuclear fusion. The sheer regulatory requirements for nuclear safety mean that, like rocket launches, the history of demonstrated safety is going to be an inbuilt moat.

3. The ability to out-innovate competitors: internal knowhow and culture around innovation

Tesla famously gave away its patents for competitors to copy and still managed to become a huge company with a market cap of $900bn. How?

I think the answer lies in a given company’s ability to continuously innovate and, perhaps more importantly, its ability to tell the story of how it continuously innovates. Telsa does that exactly. Part perception, part truth – Tesla’s moat lies in its ability to be always innovating. Competitors can copy your products but they can’t copy your culture.

(However, this is a tricky moat as almost all founders believe they’re innovators or their company culture is innovative. So it’s easy to fall into a belief that you have this moat while you may actually not be innovating fast enough)

Summing up

A single patent is probably worthless, but all other ways of building moats still exist for a deep-tech company.

So, the question a deep-tech company should really be focused on is not so much what to patent but rather what would be hard to copy for a well-funded competitor.

This essay is part of my book on mental models for startup founders.

Join 150k+ followers

Follow @paraschopra