Last week, after reading about governance systems that improve upon democracy, I went deeper into market-based approaches of making policy decisions. Markets and governance seem two very different things, but as you will see in this article, there are benefits of taking good ideas from both combining them.

When you consider democracy, think about a group of people with different educational backgrounds, different interest levels and, most importantly, different preferences (some like guns and some don’t). Now, all members of this disparate group decide equal votes is a good idea and what they get is an average opinion that nobody likes. That’s democracy in a nutshell.

Markets: make it profitable for someone to make your life better

Markets are a wonderful mechanism. The profit motive creates incentives for entrepreneurs to make your life better, and competition drives down the cost you have to pay for an improved life. Airplanes, TV, air conditioners, refrigerators, wine, video games, paracetamol – these endless varieties of conveniences were once luxuries or fantasies. If economic markets make it profitable for entrepreneurs to put an effort into making your life better, why not design a political market that makes it profitable for politicians to do the same?

Here’s what Milton Friedman thought about political markets:

“I do not believe that the solution to our problem is simply to elect the right people. The important thing is to establish a political climate of opinion which will make it politically profitable for the wrong people to do the right thing. Unless it is politically profitable for the wrong people to do the right thing, the right people will not do the right thing either, or it they try, they will shortly be out of office.”

Nobody has a straight answer yet on how to make it “politically profitable for the wrong people to do the right thing” but a starting point could be prediction markets. This is because the question we should ask about governance isn’t who should rule, but what mechanism can help us discover and implement better policies over time. An ideal system will make specific people (politicians) immaterial when it comes to society’s progress.

What is a prediction market?

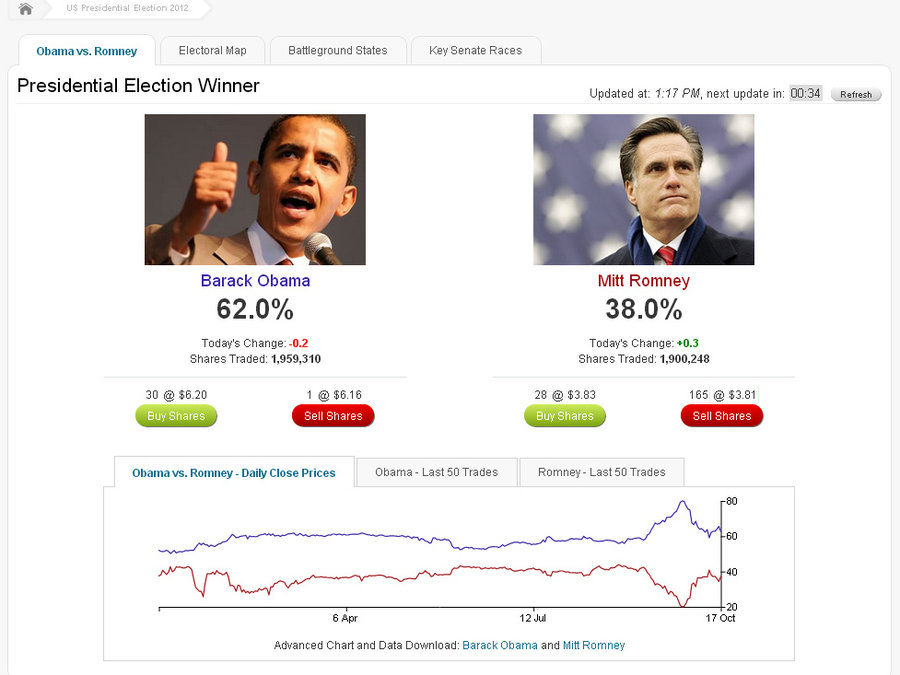

A prediction market, as the name suggests, is a market where people come together to trade in order to make a profit from their beliefs about future events. Imagine there’s a future event: ‘BJP will come to power in India’s 2019 general elections’ with two options ‘Yes’ and ‘No’. Anybody can create a contract on the prediction market for this event that will pay the owner of the contract $1 if in future the real result turns out to be ‘Yes’ (and pays nothing otherwise).

When an event is listed, its price starts at 50 cents. Anybody can trade on the market and if their expectation of a ‘Yes’ outcome is 90%, their expected value of this contract is 90 cents. Seeing the contract being sold at 50 cents on the market, a trader (who can be anyone) smells a profit-making opportunity and purchases it. In this process, s/he pushes the price upwards and the contract starts selling at a higher price (say 60 cents).

Now, if another trader comes along whose expectation of a ‘Yes’ outcome is 10%, s/he will short-sell (borrow and sell shares at the current price of 60 cents and buy back at a lower price of say 10 cents, netting 50 cents of profit). Doing this short-selling drives down the price. In this manner, buying and selling on a prediction market changes the price of the contract.

Properties of prediction markets

Here are all the reasons why prediction markets are so wonderful:

- They incentivize people to seek information. Most people are apathetic to future. What if you could make finding evidence on whether Mumbai’s sea level will rise in next 2 years or not a profitable endeavor?

- They force people to be precise with their claims. Many disagreements happen because of different interpretations. Is global warming real or not? It depends on what you mean by ‘real’ and how you define ‘global warming’. But if you create an event on a prediction market, you have no choice but to make a precise, measurable statement such as ‘2020 will be the warmest year in terms of global average temperature as measured by NASA pathfinder‘

- They efficiently aggregate disparate sources of information. Since prediction markets incentivize people to seek information and then trade based on that information, the price of the contract aggregates all information available (to traders). In fact, empirically, the price of a contract (say 65 cents for whether BJP will win 2019 India’s general elections) is the collective estimate of the (65%) probability of the respective event being true. This benefits public because they get aggregated info at one place rather than seeking and aggregating information themselves.

- They scale well with number of people and opinions. Traditional knowledge aggregation and dissemination mechanisms (news channels and polls), become confusing with more number of information sources. Markets become better with number of people engaged in them (as people have the incentive to make profitable trades if they have info that others lack

Reading resources on Prediction Markets

I have learned a lot from Robin Hanson and Paul Sztorc on this subject. Many of the resources I mention here come from them.

1/ Start by reading this short paper by Paul (@Truthcoin) on what makes prediction markets so compelling. He argues, and I agree, that prediction markets are a threat to gatekeepers and that’s why they keep them illegal.

2/ The scientific journal @Nature has a feature on prediction markets that I highly recommend for a detailed introduction. It also cites research papers on the subject (in case you want to go into details).

3/ Then read about the science of prediction markets by Hypermind (a live prediction market that you can participate in).

4/ A variant of prediction markets is decision markets where taking decisions are taken automatically based on predictions. @RobinHanson, the godfather of prediction markets, recently released a call to adventure encouraging younger folks to carry the baton for making collective decision-making better via prediction markets.

5/ I HIGHLY RECOMMEND watching this one hour video where @Truthcoin (Paul) talks about why self-governance is necessary but inherently contradictory and how prediction markets are a step forward in designing better governance systems.

6/ Can prediction markets be used beyond governance? Absolutely yes. This paper by @Truthcoin is a treasure trove. It lists applications of PMs in a) ending debates; b) detecting lies; c) whistleblowing; d) insurance; e) funding public goods.

7/ What caught my eye was the application of PMs in funding public goods. Essentially, you bet AGAINST getting a public good. If you want a park near your house, you bet that it won’t be built. If enough people bet along with you, a contractor can short that bet and claim the profit to build a road. No government required!

8/ If you want to go deep into *designing* prediction markets, I found this lecture by Prof. Yiling Chen of @hseas really good.

9/ Another way to learn more about designing prediction markets is to read whitepapers of new and upcoming crypto-currency based prediction markets. There’s @Augur, @Gnosis and BitcoinHivemind (project by @Truthcoin).

10/ THE most difficult part of prediction markets is designing neutral parties that can be trusted with providing data that resolves a prediction. For example, who should resolve whether the prediction ‘BJP will win 2019 election’, came out to be a ‘yes’ or a ‘no’ in reality? People will only participate in a prediction market if they trust that your data sources are unbiased.

11/ If prediction markets are so wonderful, why aren’t they popular? Short answer: it’s because they’re illegal in most countries (except Ireland/UK). @lawscholar says that a US agency (CTFC) made it illegal because of lobbying by movie industry (they were worried that a prediction that a movie will bomb will make it bomb!)

12/ Most economists believe that making prediction markets illegal is unfortunate. Thankfully, there are some non-money prediction markets that you can participate. A popular one is: @Metaculus where you can find predictions on ‘Will the first crewed SpaceX flight lead to the death of a crew member?‘.

13/ If trading on prediction markets using money is illegal, what about play money? I found a research paper by Justin Wolfers and others who concluded that, surprisingly, accuracy is same for prediction markets irrespective whether real or play money is used. Read the paper here.

14/ Are Prediction Markets a panacea to all our problems? Nope. There are valid criticisms of the efficacy of PMs. One notable failure was Brexit where most prediction markets did a poor job. Andrew Gelman and David Rothschild believe the popularity of PMs could be self-destructive: people start believing the outcome of PM so much that they don’t go out and seek counter-info.

15/ Another criticism is on Futarchy (a related idea). I agree with the core criticism that markets are as effective as its participants and if they are biased or inaccurate, markets will reflect that.

16/ Then there’s this strange related idea of Assassination Markets where anyone can bet that Person X will NOT die by date Y. A potential assassin can short the market, kill person X and claim profits.

@Truthcoin thinks the concern is misguided.

17/ Finally, know that prediction markets aren’t a fiction. In corporate and academic environments, they’re thriving. There are numerous software providers for running a prediction market. Check out a review of all providers out there (by Alistair).

Join 200k followers

Follow @paraschopra