It’s easy to get bewildered by the billion-dollar valuations of startups that are operating under heavy losses. If you’ve ever wondered why would anyone pay for a company that’s not making any money, you’re not alone.

Early in a company’s life when there is much uncertainty about its future, the valuation process is more of an art than a science. However, it’s not a blind science. No venture capitalist will just hand over money to you because they like you.

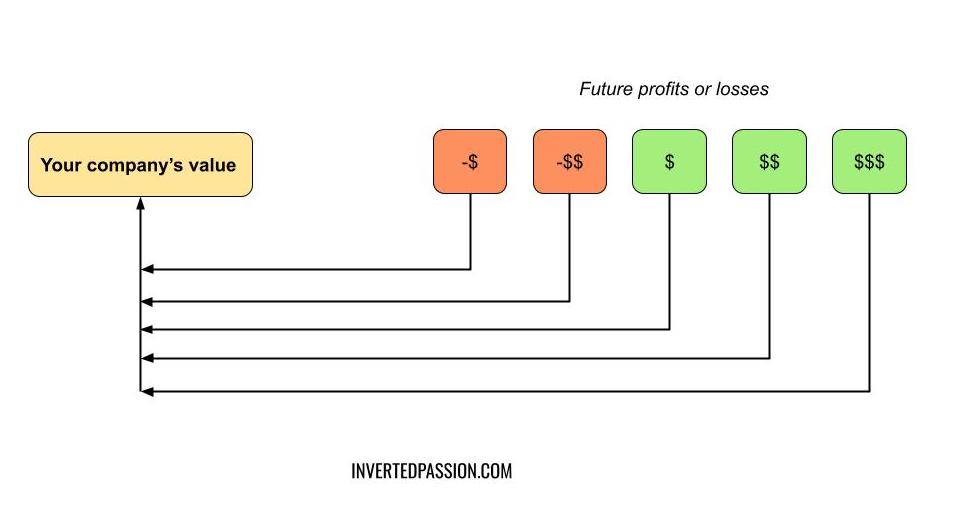

Valuation, even when it’s an art, is grounded on a very simple financial principle that an asset is worth discounted profits it is expected to produce over its lifetime. The term discounted means that the cash in the near term is more valuable than the cash in the long term. It’s easy to can find the exact formula for calculating the discounted cashflow.

However, more important than the formula is to understand the implication of the concept on startups.

The first implication is of rapid revenue growth expectation by investors. A startup typically requires upfront investment before the product hits the market. This suggests that investors actually expect losses in the initial years. With these losses that are in the near term, because of the future discounting factor, the only way an investor can justify a positive valuation of the company today is if he expects the profits that are far off in the future to be substantially larger than the losses incurred today. This expectation of future astronomical profits is what drives the growth-at-all-costs expectation that VCs have for their companies.

The VC thesis typically is that a company can always become profitable by cutting costs but it shouldn’t cut costs too soon before reaching its full potential. Sometimes it works when young companies achieve a market leader position after loss-driven growth and start generating profits to compensate investors for early profits. This is what happened with Facebook which was loss-making in the early years, but today is extremely profitable.

However, the majority of times, the thesis doesn’t materialize and hence the high failure rate of even VC-funded startups. If there’s no clear pathway to profit, no matter how high the revenue, a company is of zero value. This is why smart entrepreneurs have their eyes on both aspects: loss-fueled growth of the company and its transition into a profit-making machine. Just revenue is worth nothing if all of it goes into expenses and shareholders and investors get nothing in return.

The second implication of discounted cashflow is that owners of many profitable businesses don’t realize the value of their businesses. They feel pressured by the billion-dollar valuations given by VCs to other businesses. It’s important to realize that the billion-dollar valuation of a loss-making company is entirely dependent on future prospects and with a high failure rate, could get down to zero. On the other hand, a profit-making business has much more substance to justify a non-zero valuation. Unfortunately, entrepreneurs that have profitable businesses sometimes end up raising capital when they don’t need it. If an entrepreneur can calculate the value of her profitable business, she may realize that raising capital could actually be value destructive.

Remember: the end game of all businesses is a stream of profits for shareholders. Growth for growths’ sake doesn’t mean anything. Only growth in future streams of profit matters and until that becomes a reality, it’s just an expectation in someone’s head.

This essay is part of my book on mental models for startup founders.

Join 200k followers

Follow @paraschopra