Bitcoin is such a strange beast that it’s hard to really understand what it really is. Some people call it the biggest Ponzi scheme ever invented, while others see it as the currency that’ll power a decentralized, libertarian utopia. Whatever it is in reality (and whatever “reality” really means), there is no question that network effects are playing a central role in making it the most hotly debated idea of recent times.

I’m a big fan of the power of network effects and have previously written about different types of network effects. In this post, I want to talk about what network effects are at play in bitcoin. This post assumes you know what bitcoin is and how it works at a high level. In case you don’t, go through my introductory post on basics of bitcoin first.

Bitcoins without network effects

Bitcoin started as a vision and a plan for a currency system that is decentralized and permissionless. This means that the early bitcoin enthusiasts were committed to developing a system where anyone could send anyone else money without a central authority (like a bank) or without requiring anyone’s permission (like a government, when you do cross-border transaction). Running such a payments network costs money (ask Visa about it). You have to purchase computers, pay for network bandwidth, storage and electricity.

Early bitcoin enthusiasts invested their hard earned money and time in setting up this network. Let’s assume that the cost of doing this was $X and the network had a total of BTC A amongst all of them.

This gives us a bottom limit for the price of bitcoin in early days. They couldn’t spend BTC for pizzas yet but if someone had come to purchase BTC from them, you’d expect them to at least want to recover their investment by offering X/A exchange rate (for USD/BTC) for offsetting their investment in electricity, storage, bandwidth. (You can incorporate opportunity cost of their time in it as well).

Bitcoin solves real world problems for someone

Bitcoin’s properties make it an excellent choice for certain types of transactions that are difficult or impossible for traditional alternatives like banks or credit card networks. One such problem is cross-border transactions for illegal items. Bitcoin serves this real-world need.

Imagine a girl named Rose wants to purchase a book that’s banned in India but is available at UK shop. Although the book is not costly ($100), getting the money across from India to UK shop is difficult. Out of fear of government action, she obviously would not do the transaction via credit card and she also doesn’t have a trustworthy friend in the UK who she can ask to purchase the book and ship. Note that this is a real need that bitcoin network is uniquely positioned to serve because it’s decentralized and permissionless.

For doing this transaction, Rose has following options:

- Take services of a money laundering network. Dealing with such people is risky and they charge a significant commission for their services.

- Setup her own computer in bitcoin network and mine bitcoins. She needs to run it long enough to “waste” $100 worth of electricity, storage, and bandwidth to mine and send $100 * A/X worth of bitcoins to the UK shop. She convinces the UK shop to accepts the bitcoin because proof of work part of bitcoin protocol gives them confidence that Rose would have necessarily spent $100 worth of money to generate this amount of bitcoins. They can use the same argument to persuade their suppliers to accept the payment in bitcoins

- She can purchase bitcoins from a bitcoin enthusiast (or miner) in India giving her USD (or INR). She will pay $100 + a premium to get $100* A/X worth of bitcoins. She needs to pay a premium because she is getting bitcoins instantly, without setting up the full miner node and waiting for bitcoins to be mined. The bitcoin miner will charge a premium for his services. Note that, unlike money laundering people, bitcoin miner doesn’t need to know that Rose will use bitcoins on something illegal.

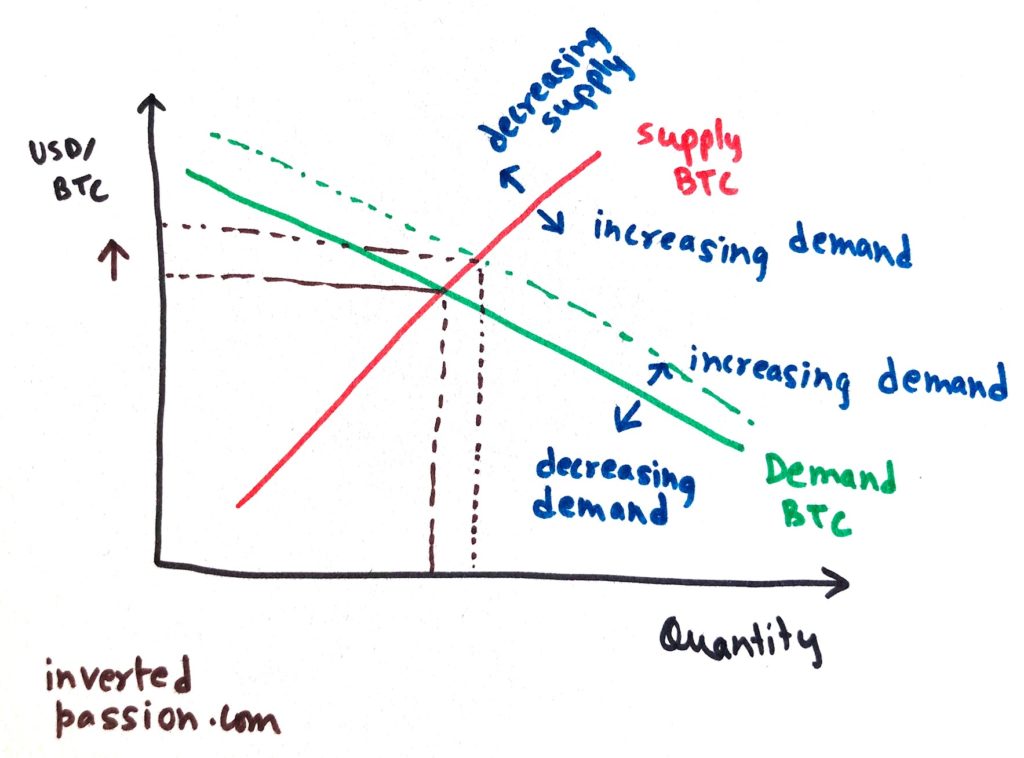

The premium paid by Rose to bitcoin enthusiast drives up the price of bitcoin. It’s due to the demand-supply rule taught in the Econ 101 class. As demand for bitcoin rises, given that supply is limited, the price per bitcoin rises.

Network effects of network effects

If you’ve invested or purchased something for money, you’d hate to see its value go to zero. Because of our loss aversion tendencies, we usually hold on to objects and not sell them at a loss until we really need to (say for survival or in a panic or when a massively better opportunity comes along). This is why real estate prices in India aren’t coming down even when the demand is reducing, this is also why people will rather spend money on storing their unused possessions than sell them.

For bitcoin network to work, miners or bitcoin enthusiasts are required to spend real economic value (in terms of computation power for proof of work). If running their server costs them $1 and gives them 1 BTC, it’s likely they won’t sell below 1 BTC/USD price. Similarly, if someone accepted 10 BTC for a $100 book, they won’t sell their BTC for less (unless they really have to). This avoidance of loss gives us a lower limit for bitcoin’s price. It’s not zero.

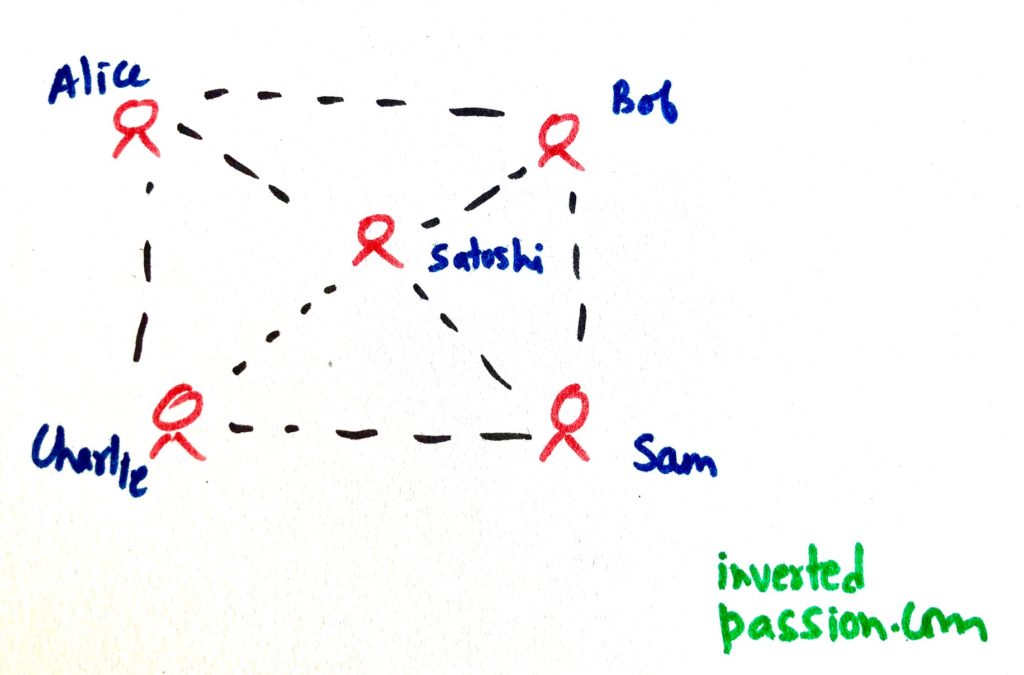

The requirement of investing time, energy or money to earn bitcoin gives it real value. And with more people having bitcoin, the utility of being able to accept and receive bitcoin increases exponentially. See Metcalfe’s law that states that the value of a telecommunications network is proportional to the square of the number of connected users of the system.

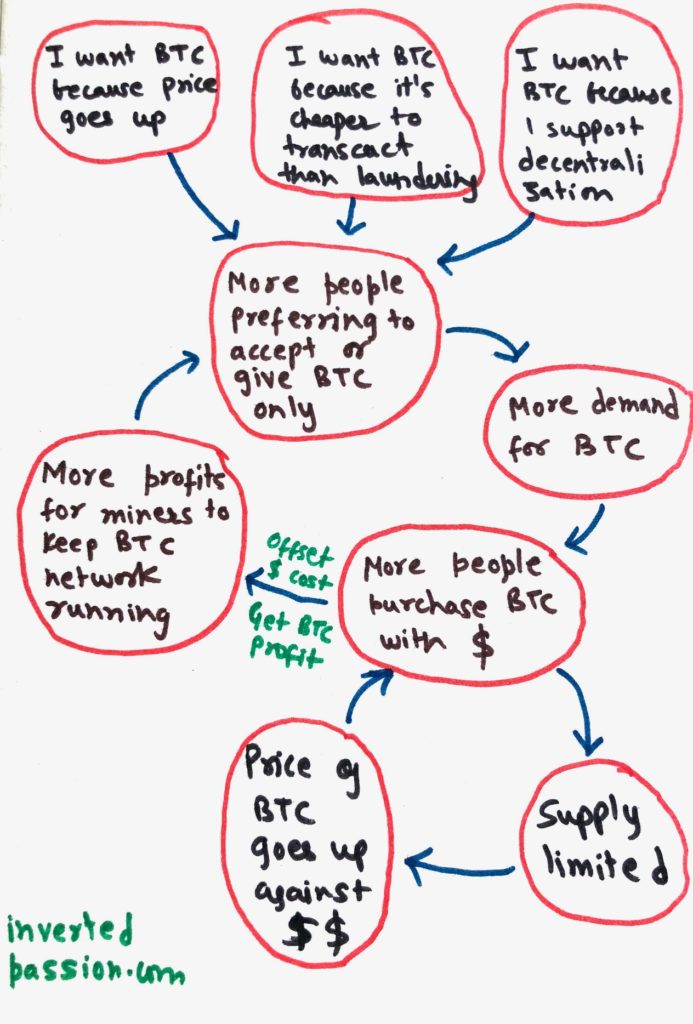

These three properties of bitcoin (having real-world use with no good alternatives, requiring an investment of money to generate currency, limited supply guaranteed by the protocol) gives it multiple network effects. Acceleration in any one loop impacts other loops and the value goes up.

Because of its limited supply, people are hoarding bitcoin and that reduces its utility as a currency. But the same property also gives it a lasting store of value: you know that people will always be ready to accept it whenever you want to spend it. Bitcoin is better than gold in these respects because it’s divisible and portable. If gold could be divided into infinite small values without damage, we could have been using gold as a currency. This property of bitcoin to store world’s entire economic value for a long time gives its price an upper limit. Imagine all the gold, silver and idle money in the world was stored in bitcoin’s 21 million tokens. It will definitely be larger than the current price of $8k per bitcoin or so.

What’s causing volatility in bitcoin’s price?

Starting from a price of 10,000 bitcoins for a pizza, in the last couple of weeks, the price hit a high of $20k per bitcoin and then recently it crashed to $8k per bitcoin. If there are multiple network effects going into bitcoin, why is the price so volatile?

The unsexy answer is that the demand for bitcoins is going up or down and that’s what’s causing price volatility. Why might that be happening? One possible reason is the arrival of speculators and traders in the market who do not care about the intrinsic value of bitcoin but completely base their decisions on market trends and emotions. And when it comes to trends, the network effects that drive up the price quickly can also bring down the price quickly.. Imagine in the network effects image above, instead of “Price goes up” there’s a temporary “Price goes down”, the loop will start reversing. Speculators cause short-term volatility in markets (but they also serve a useful purpose of providing liquidity). On the other hand, value-driven investors hold for long-term and do not react to short-term fluctuations.

I think bitcoin right now could be compared to pre-2000 Internet bubble where anyone and everyone had invested in an Internet stock. With the 1999 crash, many speculators lost money. However, Internet kept on booming even after 2000 crash and all Internet giants of today gained prominence despite the crash.

There’s a difference between pricing or valuing something. If you believe bitcoin solves a real-world need, it’s going to be valuable in the long run. In the short run, however, the price can go anywhere.

Thanks to Nilesh, Pranay, Roby and Aakanksha for reviewing the article.

Join 200k followers

Follow @paraschopra