There are many stakeholders of a business. There are employees, customers, suppliers, management, directors, shareholders, investors, investors’ investors, the government, and society. Things are fine when everyone’s interests are perfectly aligned.

But the more the number of stakeholders, the harder it is to keep everyone happy. When the interests of stakeholders diverge, an entrepreneur must choose whose interest must be prioritized. The choice, in practice, is hard, because some stakeholders are going to be unhappy when decisions don’t go their way. (Say, when an entrepreneur lays off employees).

In theory, though, decision-making is simple. Shareholders and investors will only remain invested in the business if they see returns on their capital higher than what they could get elsewhere (say with government bonds or public equity markets). And a business wouldn’t exist if shareholders lose faith in a business and start selling their stake at whatever price they can get. So, because a business wouldn’t exist without people who fund it, its main goal boils down to achieving what shareholders want – which, in most cases but not always, is wealth maximization.

Yes, maximizing shareholder value can come at a cost of destroying many other things that are good in the world but that’s how markets work. To change that, we need to change what our democratically elected governments allow for-profit corporations to do or not do.

Unless potential shareholders see a possibility of high return, they wouldn’t invest in a business. Without an investment, a business wouldn’t get off the ground. Hence, an entrepreneur has no choice but to start thinking like a shareholder who is unemotional about a business but is solely focused on the logic of generating high financial returns.

The focus on maximizing shareholder value may sometimes cause an entrepreneur to do things that he may not be naturally inclined to do. Even if an entrepreneur is kind-hearted and has good intentions in mind, the expectation of profit maximization from shareholders will ultimately be the biggest influencer on his decisions.

That is why starting a business to do good or change the world is such a bad idea if you’re honest about why businesses exist under our current capitalist system. If “maximizing shareholder value” sounds unsavory or too shallow, an entrepreneur is better off not starting a for-profit company.

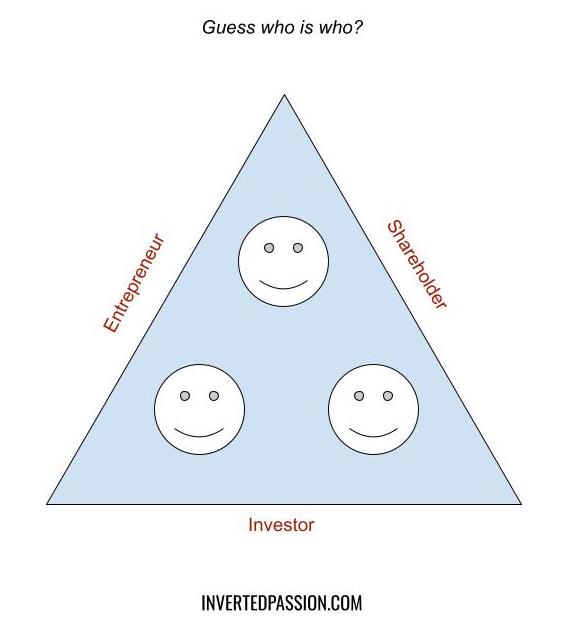

Remember: good entrepreneurs do not hesitate in taking (emotionally) hard decisions because they are perfectly aligned with what investors and shareholders want, which is often wealth maximization.

This essay is part of my book on mental models for startup founders.

Join 200k followers

Follow @paraschopra