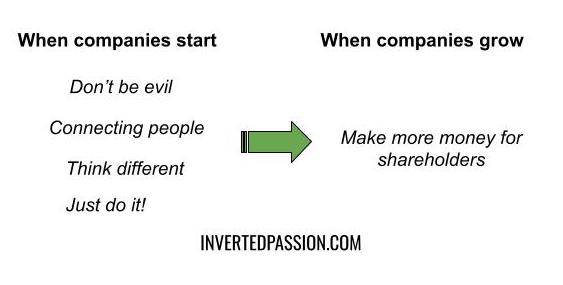

We have seen our beloved companies transform into greedy and heartless entities over a period of time. Why does it happen?

It’s usually not because founders have had a change of heart and they start loving money more than anything else. What typically happens is that incentives in an organization gradually start exclusively prioritizing profits.

This process typically begins when a company raises investment from professional financers like banks or VCs. The number one job of investment professionals is to get a return on their investment. It’s not that investment professionals don’t care about anything else, but if their job exists to make more money from money, that’s what they’ll do. With professional investors onboard, whatever a company does then is seen from the lens of the return that investors can get.

What this essentially means is that with more shareholders in the company, it matters less and less what any individual shareholder (including the founder) thinks a company believes in. The collective aspirations of the shareholders start dominating the business decisions.

So, it shouldn’t be a surprise that over a period of time, after a series of venture financing, when the shareholding is dominated by investors who want to maximize return, companies end up doing precisely that.

As the company starts getting dominated by return-maximizing shareholders, there’s a diminishing influence of the original mission, vision, or the ethical backbone of the company. This is why a founder has to be crystal clear upfront about why she’s building a company. If it’s just for the money and wealth, then there’s less to worry about because the profit-maximization value system of the company stays as is even as professional investors become shareholders.

However, if the founder is truly inspired to work towards a particular mission, then such mission has to be guarded through appropriate structure / voting rights in the company and be made clear to any incoming investor. Not all investors are alike and neither are all companies alike. So what’s needed is upfront clarity on why you’ve started a company, which should then drive the voting structure in the organization to ensure those reasons don’t get diluted over a period of time.

Losing control of the company is OK if what you want is money above all (and there’s nothing wrong with wanting that). However, it’s delusional to believe that you can achieve both: doing the right thing and maximizing profits for shareholders. That works as long there’s not a conflict between these two drives. But conflicts inevitably happen and at that point, unless you – the founder – are in control, the company will always end up choosing profits. Be ready for that if you’ve signed up for that.

Remember: know that if the majority of voting rights in the company are held by professional money-makers, that’s what they will vote to do in all circumstances.

This essay is part of my book on mental models for startup founders.

Join 200k followers

Follow @paraschopra