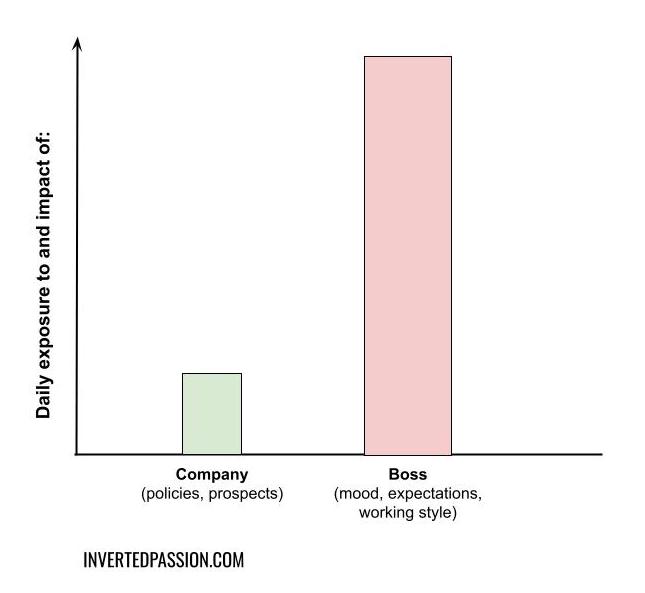

People don’t leave companies, they leave their bosses

It’s a common way of saying that so and so has left a particular company to join another company. Actually, a company is an abstraction for the group of people who comprise it. So, often, what people exit from is not the company but their interactions with their team in the company.

Most people would stick around as long as they’re treated with respect, paid fairly, instructed clearly and given work that usually falls within their abilities but sometimes challenges it, giving them opportunities to grow. Good bosses ensure that they create such conditions for people. ...