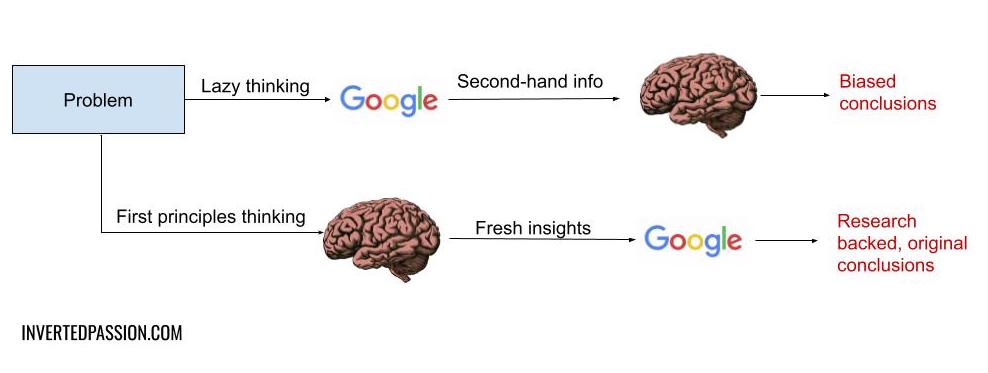

Like most technologies, search engines are both good and bad at the same time. They’re good because they open up vast resources of information. Today, our ability to know things instantly would seem like magic to previous generations. At the same time, precisely because searching is so easy, we’ve become habitual for googling for each little problem or doubt in our head.

In programming circles, coding by Googling is popular, but this is equally true for all professions. Because search results are so damn fast and convenient, we are now slowly getting wired to automatically and subconsciously Google any unresolved query in our head. This automatic reliance on search engines is dangerous because it is replacing our capacity for original thinking with second-hand information written by others. ...