Commoditize your value chain before it commoditizes you

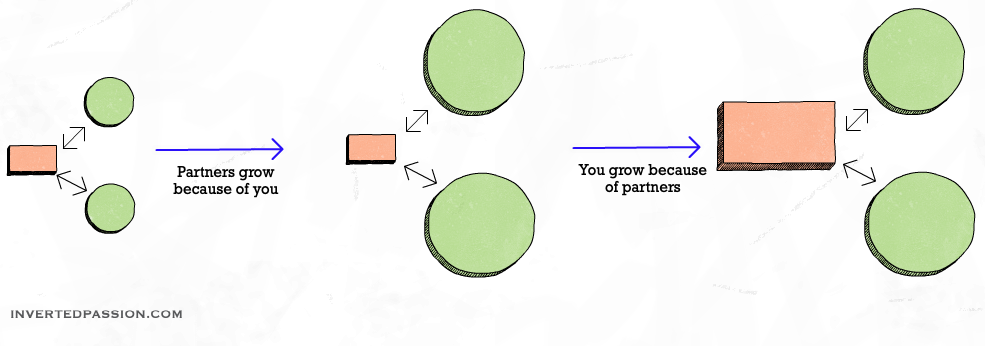

End customers typically get value through a series of businesses adding value on top of each other. For example, imagine the value chain required to bring a laptop to the end customer. The production begins with suppliers of metals and raw materials which are used by computer part manufacturers to build components like CPU, screens, and disk drives. These components are then assembled to build a laptop. The laptop needs software that’s typically written by some other supplier like Microsoft. And, finally, the fully functional, ready-to-use laptop is shipped by a logistics company to a warehouse. Customers transact with an online or offline seller of laptops which is typically yet another company (Amazon or BestBuy). ...