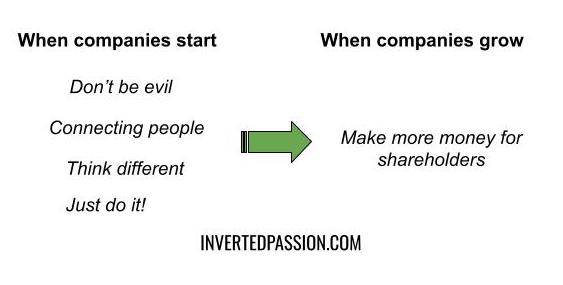

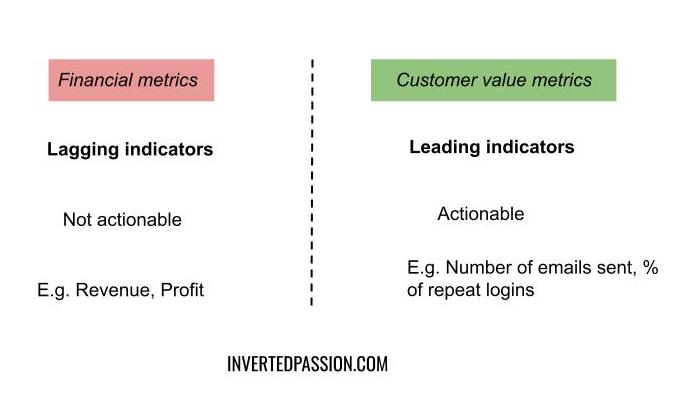

Kodak, Toys R Us, and Blockbuster were market-leading companies with hundreds of millions of dollars in revenue at their peak. During their heydays, nobody could have predicted that they will one day go bankrupt. Yet, they did and, along with that, became a prime example of why revenue or profit is exactly the wrong metric when it comes to predicting the future of the company.

Financial metrics are, of course, important from an accounting point of view. But they are strictly backward-looking. They tell you how the company has performed in the past but have very little actionable information for the future. As an entrepreneur, you need to pay attention to where future growth will come from, not simply review the past growth. That’s the job of the accountants. ...