Notes on how Supercell is run

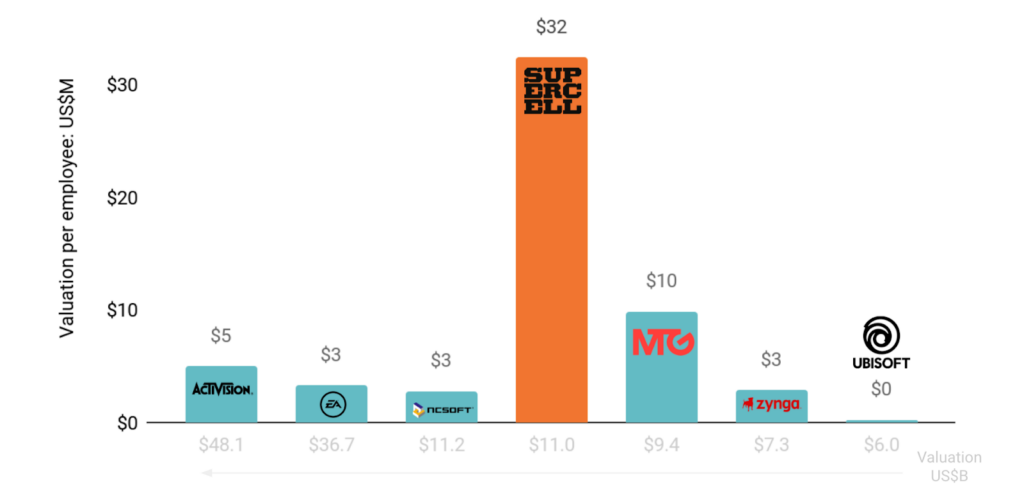

Supercell, the company behind the massively popular Clash of Clans game, has one of the highest valuation per employee figures out there: they’re valued at $32mn per employee. That’s insane! How do they do it?

1/ What struck me is the sheer number of games they kill each year?

They seem to be killing 9 games for each game they release. Some of these games have been in development for years, and have the potential to be in the top 25 games worldwide. And, yet, they get killed.

2/ Why are they killed? It’s because these games don’t meet their internal benchmarks (primary of which is 30-day retention). ...